|

|

|

| Home | Gift card legal | Gift card resources | Vendor reference | News | Contact |

| News

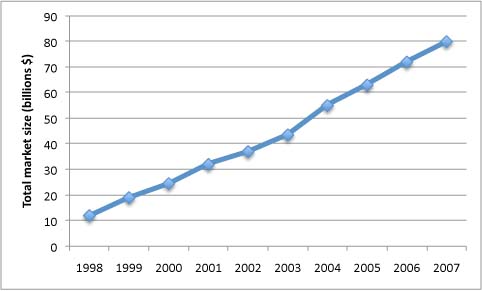

Gift Cards & Illicit Use (4/5/10) It isn't just drug dealers that are using gift cards to launder money. Apparently, there was some kind of scam involving donations to the National Republican Senatorial Committee where gift cards were used to hid the true origins of the donations so individuals could donate more then they were legally allowed to. Latest Gift Card Sales Stats (4/5/10) The latest survey by Javelin, shows a drop in gift card use from 2008 to 2009 from 66 percent of people to 62 percent. They also predict that gift cards will rebound in 2010. Really? According to the latest Economist issue, household wealth as a share of disposable income is back to 1995 levels while household debt levels are still very high, and a return to heady spending won't happen anytime soon. Nickel and Dimed (4/5/10) A couple of items in this article are troubling: the claim that gift card laws are seldom enforced and the admission by the State of Louisianna (and probably by most States with gift card law) that complaints about gift cards are rare. Why is this? Just like with the proliferation of nickel and dime fees on everything from airlines to bank accounts, companies know that people rarely make a huge stink about a small amount of money list even though they despise it. And customers are easy to forget their frustration which keeps them feeding at the same tainted trough. Gift cards are no different. Companies that sell gift cards know damn well that most customers won't bother to complain if they have a problem with their gift card. This is part of what helps them make money in a profit-by-small-fee fashion, which has become the norm for most businesses in this country. A real shame. Gift Card Scams Abound (4/5/10) Here is a TV news story about the gift card scam where someone scans the card before activation and then when it is activated they clone it and spend it. This story doesn't really tell us anything new, but when you hear it from TV, it makes it sound like the scam is happening all the time. Perhaps it is. The anchor's only suggestion is to buy a gift card from a customer service representative instead of a cashier? What exactly does that mean anyway? My suggestion is to purchase your cards from an area inaccessible by customers, such as behind the register. If the only gift cards that are available are accessible to anyone, consider buying them online. I am no really surprised that stores like Target and Wal-Mart (the two mentioned in the story) haven't fixed this problem by making their cards accessible only to cashiers. The reason they don't do this is that cards that are hidden away don't sell well and the voices of customers scammed in this way hasn't turned into a roar yet. Prepaid Cards Online (4/2/10) According to this obvious PR-based article, prepaid debit and gift cards are already a huge hit for onine purchases ($12 billion for prepaid and $2 billion for gift cards in 2009) and are set to explode to $38 billion for prepaids and $6 billion for gift cards by 2014, representing almost 10% of online sales. What is obviously missing from this is the difficulty people often have in using these types of cards for online purchases. Having briefly run a service that cashes out open-loop gift cards, I can personally attest to the fact that these type of cards are all over the board as to how they behave (or misbehave) online, even as far as major differences between two cards issued from the same bank. From differing and sometimes totally random address verification handling to holds placed on funds after a failed authorization (because of AVS randomness) sometimes for weeks, these cards are hell to try and use online. In a store, all you have to do is swipe the card, no verification required. Online, you sometimes have to know precisely what address (if any) the card is registered to, which could be none, the gift givers address, or your own if you registered it, and other times the card doesn't care about addresses. Some cards done care about address verification until you register them. Some cards just randomly stop working for no reason and you can't get a hold of a real person to figure out WTF. The bottom line is that easily over 50% of online transaction based on gift cards seem to fail, versus about 5% for traditional credit cards. The Limitations of Open Loop Gift Cards (3/31/10) If you try to use your open-loop (Amex, Visa, Mastercard) gift card for certain purchases, you will find out just how futile it can be. The problem is that certain retailers will routinely try to authorize a certain amount just to pre-validate the card. For instance, if you want to use your card at the pump to buy gas, the pump will authorize $50 or $75 just to allow you to use the card, so if you have a card that is only worth $25, there is no way it will get accepted. People don't notice this with credit or debit cards because they typically have a much higher credit limit or balance so it is never a problem. Restaurants also typically do this when running your card to leave extra room for a tip, even if you tell them to put a certain amount on the card. Facebook and Gift Cards (3/31/10) Facebook ads and games are becoming legendary for their scammyness, and it should come as no surprise to anyone that ads for free gift cards on Facebook, such as for a $500 Olive Garden gift card or a $500 Whole Foods gift card where you have to enter your mobile phone number are completely bogus and will only result in unexpected charges on your phone bill. Basic rule of thumb - if it sounds too good to be true, IT IS! Update 4/5/10: Yikes, it looks like there is more than mobile phone numbers at stake here. Some of these gift card scams involve the installation of malware on the computers of people visiting the Facebook fan pages involved or other sites. Be careful! Making Thoughtless Gifts More Thoughtless (3/31/10) I'm a little torn about this one. Friendgiftr has been infiltrating social networks with apps that allow people to purchase gift cards without ever having to leave sites like Facebook. You can also purchase them directly from their site. They recently announced a mobile device optimized store (but not native apps, why not?). On the one hand, they do have a large selection of card, but their selection isn't much different than GiftCardMall, which, in addition to all the kiosks in grocery and other stores with lots of gift cards, sells them on their site. Perhaps some people will get excited about a retailer like Friendgiftr, and it is convenient to have such a large selection of gift cards available all in one place. But I really can't as I have never actually purchased a gift card as a gift. My interest in gift card comes from the fact that people seem to want to give them to me and I am such a cheapskate that I am determined to get every last dollar from every last one. Open Loop Gift Card Scam (3/24/10) It was bound to happen; someone finally figured out how to scam open-loop (Visa type) gift cards at the checkout counter. With closed loop card, the identifying numbers or bar are visible and can easily be read by theives. Once you activate the card that has been previously scanned by theives, they can tell through online tools when the card is active active and create a cloned card which they can use to spend. When you or the recipient go to use the card, it no longer has value. With open-loop cards, this isn't possible as the identifying information is hidden in the packaging and can not be easily copied. The latest scam involves the thieves replacing the activation barcode on the outside of the packaging, which contains the code the identifies the card for activation, with a sticker that will activate a different card, which is in the posession of the thieves. The card you purchase never gets activated. The way to protect yourself against this is to be sure and inspect the packaging for any anomalies that don't look right, like a barcode sticker. Fed Unveils Gift Card Rules (3/23/10) The Federal Reserve has apparently finalized its new rules for gift cards, which are scheduled to take effect August 22nd, 2010. At least one Senator wants them enacted earlier. At least one part of the rules is a little disappointing; inactivity fees are allowed after one year of no use, but only one fee can be charged, not multiple fees. Other than that, the rules specify that gift cards must be valid for at least 5 years and has stricter rules about how information about fees must be displayed to the consumer prior to purchase. What missing from the rules? Unfortunately there is no cap on fees, no specification that cards must be replaced free of charge if they are lost or stolen, no protection if the issuer files for bankruptcy, and finally, the rules don't apply to loyalty cards, promotional cards, or to reloadable cards not sold as gift cards. Look for plenty of cards that try to slip through these cracks. For instance, if, say, a Visa gift card had an expiration date on it for less than 5 years, you are entitled to a new one after the expiration date on the card (because you can't use it anymore), but how many people will actually ask for a new card? Also, keep in mind that State laws that are stronger than the Federal gift card laws still apply. For instance, in California, you should still be able to get cash back for gift cards if the balance is less than $5, even though this isn't specified under Federal law. The best summary of State gift card laws can be found here. In the Blogosphere (3/23/10) Thanks to the Buxr blog for recognizing our contribution to useful gift card info. Plastic Jungle Raises $7.4 Million (3/19/10) Plastic Jungle announced that it has raised $7.4 million from several Venture Capital firms and plans to use the money to accelerate product development and work on other ways to create supply and demand for gift cards on the site. This is in addition to the $6 million it raised in the middle of last year. Worst Gift Card Award Goes To ... (3/17/10) Looks like JetBlue wins the award for worst gift card ever. One customer won a contest by American Express that allowed her to buy a $100 JetBlue gift card for $70. The reality of using the card however was a huge pain. She spent over 2 hours on the phone trying to redeem the card, dealt with an number of clueless JetBlue customer service reps that couldn't figure out how to apply the card, and was ultimately charged $15 for using the card over the phone. Where else exactly was she supposed to use the card as they don't allow you to use them online. This reminds me of a conciliatory $25 United Airlines gift certificate we were given after long delayed flight that could only actually be used at the airport. Thanks for nothing. Australia Gets Its Own Gift Card Trading Site (3/16/10) From what I have seen, most of the gift card auction/trading/buyback sites are focused on the US or Canadian markets. It is nice to see other markets getting some of these useful tools, like the new site Cardlimbo.com.au, which serves the Australian market. Gift Card Advice? (3/16/10) There is no question that gift cards have been hugely successful, at least if you measure how big of a market they've become. But in my opinion, the success that has been lavished on gift cards has mostly been undeserved. By just about all measures, they are a terrible product; as gifts they are usually impersonal and thoughtless, often come with rediculously high fees and short expiration dates, are easy to lose, and generally hard to get all of your value from. I suspect they have been a success because, well, most gift card issuers have been successful and tricking consumers into buying them by hiding the fees and, let's face it, most occasions that would warrant a gift card in our culture have become fairly shallow events. That being my personal view of gift cards, it is hard for me to comment positively about a website (www.giftcardgirlfriend.com) with the purpose of finding occasions for you to give the right kind of gift card, and helps you solve problems like not wanting the recipient know how much you spent on a gift card. In fact, the very existence of a site like this somewhat validates my overall view of gift cards, doesn't it? Canadian Gift Card Law has Major Loophole (3/15/10) Heavy lobbying by shopping mall owners in 2007 convinced the government of Manitoba to exempt mall issued gift cards from the law they passed that prohibits expiration dates and fees on gift cards. Legislators of course are loath to advertise this fact and people are getting bitten by the disparity, expecting their mall gift cards to have no fees or expiration dates. This is strikinly similar to the complete ignorance of open-loop cards by any gift card legislation issued by US states prior to the recent gift card statutes in the Credit Card Reform Act of 2009. Who knows if it was lobbying by the card issuers that gained them their exemption or just dumb luck, but they definitely didn't dodge the bullet at the Federal level. USPS Doesn't Have a Lock on Gift Card Theft Anymore (3/15/10) Looks like at least one UPS employee has gotten into the habit of stealing gift cards from packages shipped through his UPS store. UPS is still likely a much safer bet than the Postal Service for shipping gift cards. The same rules still apply, don't make it look like a gift card when you ship it. Gift Cards and Smart Phones (3/11/10) As smart phones become more ubiquitous, applications related to gift cards are bound to appear with greater frequency. We've previously reported on an iPhone app from Wildcard Network that allows you to store your gift card information (so you have it when you need it), but few gift cards are supported. Joining the ranks of imperfect but promising applications is an iPhone app from GiftCards.com that allows you to activate or lookup the balance your your Visa gift card, presumably only the ones sold by GiftCards.com. The main problem with this is the disconnect between the buyer and recipient of the card. The buyer might think it is a cool idea but the recipient might not have an iPhone or not know about the app, so it does them no good. But, these apps may be imperfect, but they are a step in the right direction. What might make gift card apps more practical is the acceptance of a purely virtual app based gift card, possibly a counterpart of a physical card (i.e. you could use either/or) that is accepted by retailers. Consider this: I recently flew and used nothing but a bar-code displayed on my iPhone to get through TSA security and board the airplane. If this works with TSA, surely it has to be possible eventually with retailers. Short of that, I would love to see someone create an app that allowed you to look up the balance on ANY gift card (each reatiler/issuer would have to be accomodated separately - a lot of work) simply by using the phone's camera to view the front of the card, much like apps that can do a price check by using the camera to view a bar code. Now THAT would be useful! Gift Cards Boost Sales in January? (2/16/10) There is some speculation that the use of gift cards may have been a reason behind January's modest sales growth over 2009. (article) That means people are smarter and are using up their cards faster. Open-Loop Growing Fast (2/16/10) At least in the UK, open-loop cards apparently grew by 70% in the 4th quarter as compared to the same quarter in 2008, while closed-loop gift cards were up only moderately at 2.8%. Talking Customers out of their Cash (2/9/10) Ok, this is sort of a good idea. An entrepreneur is working to create gift cards that have a customer selected expiration date. After that date, the remainder balance on the card is donated to a charity, minus (and heres the hitch) a percentage of the remainder that the issuer gets to keep. Pretty smart way to get customers to be happy about losing their gift card breakage. Targets Mobile Gift Cards (2/9/10) While the details are as of yet thin, Target announced gift cards that can be kept on mobile phones. Hey, I am for anything that makes it more likely you will have your gift card with you when you shop. Canadian Gift Card Laws (2/9/10) In Canada's Nova Scotia province new laws came into effect on Feb 1, 2010 that prevent gift cards from having expiration dates or inactivity fees of any kind. As a result of this, one chain of malls is crying foul and has suspended sales of their mall-endorsed Mastercard gift cards. They stated a campaign to get the laws changed. One interesting note is that the website set up for the campaign claims that 96% of all gift cards are redeemed before the 15 month window after which fees were previously charged. If true, and not just political retoric, this would seem to indicate that perhaps people are more diligent in Canada about using up their gift cards. The Gift Card Economy (2/9/10) According to a recent article, PlasticJungle (a gift card trading site) claims that there are $30 Billion worth of unredeemed gift card in consumers hands. Gift Card Scam to Watch Our For (2/2/10) There is a type of scam involving gift cards that people should be aware of. Apparently someone is sending out spam text messages claiming that the recipient has won a Wal-Mart gift card. When the recipient calls the number in the text message, they are told that they need to pay for shipping and are asked for a credit card number. Presumably then all kinds of charges are run on the credit card. The moral of this story is don't give out any sensitive information unless you are sure of whom you are talking to. Always find the number of website address yourself to be sure you are talking to the right people. Trouble with Gift Cards (2/2/10) Trouble with your gift card at Best Buy? Be careful not to get arrested like one customer did. Seems the Best Buy staff was having trouble with her AMEX gift card and made the unfortunate assumption that she was trying to pass of a tampered with gift card. She wasn't, the Best Buy staff were just idiots. What's worse, they actually did this to another person trying to us a Mastercard gift card the same night. Reloadable Cards & The Credit Card Act of 2009 (2/1/10) As always there will be loopholes to the protections offered by the Credit Card Act of 2009 that card issuers will try to exploit. One such loophole, chronicled here, is that reloadable cards that are not marketed as gift cards are exempt from the provisions of the regulations under that act, which makes no sense considering those are more like credit cards which are the main focus of that legislation anyways. With this loophole, look for prepaid open-loop (Visa) gift cards to be instead convereted into reloadable cards that don't say gift on them. Make Companies Obey The Law (1/30/10) As we've stated a number of times, there are many companies that either aren't aware of the laws around gift cards, don't train their staff properly, or just don't care to obey them. So when company refuses to givey ou cash back for your gift card valued under $10 (in California), it may not be worth the couple of bucks to you to file a complaint with the proper authorities, but it will help the next guy who tries to get their money. Do the right thing. Gift Card To Pay Utility Bills (1/30/10) Someone came up with the idea of a gift card that could be used to pay utility bills. Rather than give you some random gift card, people could sign you up for this gift card that was accepted by certain utility companies. Sounds like an interesting idea but it must be very regional as none of the companies you can pay I have ever heard of. California Goes For The Gold (1/27/10) Looks like there is a proposed bill SB885 in California which aims to raise the amount you can get cash back for on a gift card (close-loop only) from $10 to $20 and to do away with dormancy fees. Don't Buy Unpackaged Gift Cards Off The Rack (1/22/10) This story reminds us that it isn't a good idea to purchase gift cards that are not packaged with the numbers clearly inaccessible where anyone can access them. Gift Card Auctions (1/17/10) Our gift card resources page lists a couple of sites (Bidees, DFWbid) that have special types of auctions where you bid on items with specially purchased auction credits and any bids that are not winning are lost. From the get go I felt these were nothing more than scammy auctions that benefitted the company much more than the customers, and the tech blog TechCrunch has an excellent post on a similar site BigDeal that shows just how stupid these type of auctions are. Think of them as a pyramid scheme - the winner of the auction probably gets a decent deal, but everyone else, the vast majority of people, get screwed. What Gift Cards Are Really For (1/16/10) Gift card issuers like to claim that gift cards are the most popular gift. Cashstar, a company that manages digital gift card networks for retailers, recently shared some trends that point out that gift cards may be popular, but they are most often the gift of LAST resort, not first choice. My interpretation - people often buy gift cards when they don't have time to get another gift or just plain forgot to get a gift. Getting Help With Gift Card Problems (1/16/10) I've found this to be true with many problems. One couple was promised a gift card by ADT as a promotion for signing up for a security system, but despite months of waiting and many calls, it didn't come. So they called their local news channels problem solver, they contacted ADT, and the gift card finally came. The unfortunate truth is that often it is only the threat of negative publicity that will get companies to do the right thing. (story) Regulations vs. Education (1/15/10) According to this Sacramento Bee article, the author had a lot of trouble getting cash back for gift cards that were valued under $10, which is clearly spelled out under a California gift card law that has been in force for over two years now. This is similar to the problems with trying to use a low value Visa or Mastercard gift card at a point of sale via a split tender transaction, where you pay with two forms of payment, your low value gift card and something else. Open-loop card issuers claim that this is possible but in reality very few retail locations either allow this or have trained their clerks to be able to do this. Are you really going to take a retailer to task for not giving you back $5 when they should by law? I wish more people would, then perhaps retailers would properly educate their staff. Gift Cards From Banks (1/15/10) According to this story, getting a general purpose (Visa/Mastercard) gift card from a bank is a royal pain in the butt. I understand that banks have financial reporting regulations but do they really need to make you jump through all the paperwork hoops for a $50 gift card when you can buy one at CVS or Safeway with zero documentation? My guess is that the share of gift cards sold directly from banks is a VERY small part of the market because of this. Paying Bills With Unwanted Gift Cards? (1/12/10) GiftCards.com recently launched a new service where people can trade in their unwanted gift cards and pay bills (electric bill, cell phone bill, car payment) with the cash they get. The first question that comes to mind for me is, is this something people actually want? Why wouldn't someone just get cash for their unwanted gift card on any number of the available sites that offer this service and use the cash for whatever they want? Electronic Gift Cards (1/10/10) I haven't quite made up my mind about electronic gift cards (e-gift cards?). Electronic only gift cards like one we recently received for Barnes & Noble have been around for a while but have mostly been online only, but a new offering by CashStar, for stores such as Home Depot and CVS, allows for gift cards that can be printed out and taken to a store to use in person, as well as online. I like the idea of having an email trace of the gift card as it makes it less likely that I will lose it completely (such as I might lose an actual plastic gift card) but I am less likely to have a gift card with me when I visit a store if I have to print it out first. Stores Playing Gift Card Tricks (1/6/10) It seems that banks aren't the only ones out to screw customers with the small details. This news story reports that many stores will gladly cancel a lost gift card but they won't replace a lost gift card without the original receipt. I have never heard of anyone saving a gift card receipt. More Kudos for Amex (1/6/10) Amex seems determined to provide the best gift card product. One customer reports their gift cards being lost in the mail, so Amex simply invalidated the old cards and send him new ones. (story) The End of the Gift Card Party? (1/4/10) Does this lawsuit spell the end of the gift card party as retailers and card issuers know it? At issue is the remainder minutes on AT&T prepaid calling cards (breakage); there is often not enough left (pennies?) on a calling card to make an actual call, so the money is effectively lost. The lawsuit aims to repatriate that money into the State unclaimed property coffers, which, as anyone with a brain knows generally goes eventually into the State's general fund, because unclaimed property of this type is VERY hard to return to the consumer. What is interesting is that the State is going after a smaller breakage of this type. This could either happen because States are truly concerned about the consumer (not betting on it) or they are increasingly looking for additional cash to grab (most likely). In either case, combined with new State and Federal gift card laws, this could be the end of the party for gift card issuers. State Gift Card Laws (1/3/10) Here is an excellent summary of state gift card laws by the National Conference of State Legislators. What Gives? (12/27/09) A recent Ebay auction sold a $100 Visa gift card for $161.50. That makes no sense to me.

Wisconsin Gift Card Legislation (12/22/09) Right on the heels of Colorado's announcement about pursuing gift card legislation next year, Wisconsin, which has no current gift card consumer protection laws, is discussing a gift card law outlawing service fees and expiration dates. Colorado Gift Card Legislation (12/21/09) While the details of Colorado's proposed gift card legislation (press release) have not been fully released, it sounds like is like a gift card law on steroids. It bans expiration dates and fees, including activation fees, monthly fees of any kind, fees for checking balances, etc. It also allows consumers to get cash back for balances less than $5. What is unclear is whether it will apply to open-loop (Visa-type) gift cards and whether it will conflict in some ways with the Federal Reserves gift card rules. The Ideal Gift Card (12/18/09) What gift card has no fees, never expires, is always worth exactly what you paid for it, can be spent anywhere, and will never be subject to bankruptcy? Well, none. But I have an idea for a gift card that will satisfy all of that. Basically, it would be a gift card with a hollowed out spot in the center where you can stuff some cash. Gift Card Awareness (12/18/09) This article in the Chicago Tribune's Consumer Help column tells us a couple of things anyone should know: First, contacting either a newspapers or TV stations consumer help guru is possibly the best way to get stubborn banks or other companies to change their minds and give you what they want. Almost every story I have read in one of these columns has resulted in the company reversing its previous position. Second, rediculous policies still exist for gift cards, like in the reference article where a Visa gift card expires and loses ALL of its value in less than one year. Despite the best efforts of legislators, this behavior will continue, as trickery is the way many companies and most banks make their money these days. With gift cards, you must ALWAYS be on your toes, even after the new gift card laws take effect next year. iPhone Gift Card App (12/15/09) If this app from Wildcard Network works the way it claims, it may solve a problem I've always had with gift cards, not having them with me when I am at a store and want to use them. The app allows you to virtually store your gift cards in the iPhone so that you can use them at any time. You can even check balances right from the app. The app is free. What is the downside? Very few supported cards right now. For instance, I have in my wallet two Barnes & Noble gift cards and a Home Depot gift cards. Neither of them is supported at this time. They also don't support open-loop (Visa/Mastercard) gift cards (yet?). If they are able to widen their support to most gift cards, this could be a very cool app. Gift Card Fees Aren't Dead Yet (12/8/09) As this Forbes article indicates, fees on bank gift cards are far from dead. While this will change somewhat when the new gift card laws take effect in 2010, banks seem to be trying to wring as much out of their gift card customers as they can right now. Worst offender? Bank of America's gift card doesn't have any dormancy fees; the card simply becomes worthless after 9 months and can get you an overdraft fee. Enjoy it while you can BofA. Innovative Gift Cards, or Junk (12/8/09) Here is a blog post showing some new dual purpose gift cards; one glows, one is a remote control car, one is a USB key, one is an MP3 player, and one is a digital camera. Is this really what will drive people to buy gift cards, or are stores just desperate? The Tide Turns Negative (12/6/09) To keep abreast of new information related to gift cards one of the tools I use is Google Alerts which monitors news articles and blog postings for keywords. The last month or two, a majority of the articles I have come across have been negative towards gift cards in one way or another, either related to gift card sales going down, the "pitfalls" of gift cards - the fees, expiration dates, and bankruptcies. Is it possible this represents a new trend in gift cards that is unrelated to the recessionary decline in general? It isn't like there hasn't been ample information about the negatives of gift cards, and yet consumers have shown little regard for this. Is the amount of information now being put in consumers faces enough to sour them on gift cards. This will be interesting to watch. Gift Cards vs. Cash (12/5/09) Someone did a survey where they asked people if they preferred gift cards vs. other gifts, such as DVD's. The very not surprising results were that people preferred gift cards. Perhaps a better survey would be to ask people if they preferred gift cards or cash. My prediction: 99% of people would take the cash. Gift Card Toys? (12/4/09) I'm scratching my head about this one. Do people really want gift cards that double as toys? Will it get people to buy gift cards that otherwise might not? Open vs. Closed Loop (11/27/09) The latest Tower Group report on gift card sales has some interesting numbers of open-loop vs. closed-loop gift cards. According to their research, open-loop will be half of close-loop for 2009, at $29 billion and $58 billion respectively. I had thought open-loop gift cards were nearing about the same sales as closed-loop. Dreaming (11/21/09) In a two-part interview (part one, part two), a spokesperson from the Blackhawk Network, a division of Safeway that operates the Gift Card Mall service found in Safeway and other locations, has some interesting prognostications for gift cards this holiday season. Going along with other industry insiders, they predict growing sales for gift cards, whereas every independent survey (such as from The Tower Group and Archstone Consulting) predicts declining gift card sales. They also are touting new consumer behavior, such as people purchasing store gift cards over time to save up for a big purchase, instead of just putting money in the bank. I think they are drinking to much of the company Kool-aid. These predictions sound more like fantasies. In difficult economic times, people tend to make smarter choices, and not buying gift cards, especially the kind with high fees, is among those smarter choices. There is just too much information being presented in the mainstream media for customers to ignore the fees any more. And worries about the health of retailers will surely keep consumers from treating a retailer like a bank for fear of losing all if the business goes into bankruptcy. Gift Cards Just Can't Get a Break (11/20/09) The Tower Group expects gift card sales to drop 7% from last years sales, which are down from 2008 levels. Even the National Retail Federation reports that gift card spending will drop this holiday season. Most commonly cited reason: gift cards are too impersonal. And the Wall Street Journal and Time Magazine (among many others) feature articles (WSJ, Time) that advocate giving cash instead of gift cards. Have gift cards peaked? Are consumes getting smarter? Strangely though, Canadians seem to be giving more gift cards than ever. Consumer Reports' Annual Gift Card Gotchas (11/18/09) Consumers Union released their annual reminder list of gift card gotchas. Federal Reserve & Gift Cards (11/16/09) The Fed announced its new proposed rules for Gift Cards from the responsibility given to it by the Credit Card Accountability Act of 2009. The major change from rules on gift cards previously discussed is that rather than allowing monthly fees after 12 months, they will require that no fees be charged until 12 months of inactivity have passed. That won't matter for people who receive a card and put it in a drawer. The other interesting proposal is regarding the expiration of a gift card and the expiration date printed on the card, as it is with almost all open-loop (Visa-type) gift cards. In some states, these cards often have expiration dates that is before they are legally allowed to expire. The new rules include two proposals, one that would require the expiration date on the card to be at least 5 years out from the purchase of the card, and the other to allow for a shorter expiration date to be printed on the card but to allow consumers to receive a new card at no cost. It seems that it is up to Congress to suggest which proposal should be adopted. Comparing Gift Cards (11/12/09) Here is a handy guide that compares gift cards on fees and other things. Best Punishment for Stealing Yet (11/5/09) Two women Pennsylvania agreed to walk around in public carrying sandwich boards that announced that they had stolen from a 9-year old after stealing the little girls gift cards, in exchange for no jail time. Perhaps if they made Postal employees do this when they were caught stealing gift cards ... Gift Card Stealing Not Limited to Postal Employees (11/4/09) I recently came across a story about an IRS employee arrested for stealing gift cards from the mail being delivered to the IRS facility where he worked. Apparently stealing gift cards from the mail isn't limited to Postal employees. Now you have to work about the workers in the mail room at your business. If you send gift cards by mail, some simple precautions will make them more likely to arrive. Don't put them inside a holiday card. Theives look specifically for holiday cards and can feel the shape of the gift card inside. Instead, ship them in a box, a padded envelope (to make it look like someting other than a holiday card), or a larger manila envelope (so it won't look like a holiday card). If you can feel the gift card in the packaging, so can someone else. If you do mail it along with a holiday card, make sure the envelope is sealed properly and the contents inside aren't too loose. If they are, the Post Office's automatic sorting machines may shred the envelope. Buy Postal Service insurance to protect the gift card. To insure an item up to $50, it costs $1.75. Up to $100 costs $2.25. You get the idea. Gift Card Spending This Holiday Season (11/4/09) I've come across two surveys recently that predict different results for gift card spending this holiday season. The first survey, from Archstone Consulting Group predicts flat sales to sales dropping by 5%, which seems like a logical conclusion given the state of the economy. This is similar to what they predicted last year and they were right. The second survey, from Givex, predicts that gift card spending will rise. So who is right? Given that Givex is in the gift card businesss (they supply the infrastructure for gift cards), their results sound more like a press release. Archstone is a consulting company that serves many industries and seems like a less biased entity. I suspect the Archstone's predictions are more likely. Western Union Gift Card (11/2/09) Western Union just announced a new prepaid debit/gift card, but I think they missed the real feature that Western Union as an organization could offer. Hardly a week goes by that I don't hear about a Postal Service employee getting caught stealing gift cards from the mail. The mail is clearly an insecure way to send gift cards and when you do send them via USPS, you take your chances. You can purchase the Western Union gift cards online and have them sent to the recipient Fedex Overnight, second day, or regular First Class mail. Western Union's real strength is the number of locations - about 345,000 agent locations worldwide. If Western Union allowed you to send the gift card to the recipients nearest agent location, that would skirt the mail safety issue and would be a significant value-add for a gift card that is otherwise indistinguishable from the rest of the pack. Consumer Federation of America Gift Card Brochure (10/27/09) The Consumer Federation of America has put out a gift card advocacy brochure to help consumers better understand gift cards. More No-Fee Gift Cards (10/27/09) GiftCards.com has jumped on the no-fee band wagon and now offers Visa gift cards with no expiration or maintenance fees. As far as I can tell, this applies to all the fees they previously had, including the monthly administrative fees, fee to close an account, fee to replace a lost or stolen card, balance inquiry fee, etc. Survey Says ... (10/27/09) As these survey results seem to indicate, consumers don't really understand the true costs or fees associated with open-loop (Visa/Mastercard) gift cards. Probably the most understated result is the question where 17 percent said they had trouble spending the remaining amount on their card becasue a merchant refused to split the transaction across multiple payment types. What is missing is the fact that the other 83 percent of people never had a problem BECAUSE THEY DIDN'T EVEN KNOW YOU COULD DO THIS! :) Closed-Loop Gift Cards Are Not Very Safe (10/24/09) This story about gift card thieves is both amusing and educational. On the amusing side, the thieves were caught because Toys-R-Us officials became suspicious when 4,600 calls to the automated gift-card balance line came from a single phone number at the thieves house, which ultimately resulted in thieves being arrested. On the educational side, it reminds us that closed-loop (Target, Toys-R-Us, Borders) gift cards are generally not safe because the numbers are not protected from view (or swiping) as open-loop cards are, in protective packaging. This makes it very easy for thieves to copy the numbers. They then monitor the card using the card's support line or at the retailers website to check when it is actived. When it is activated, they encode the newly activated cards number onto a phony gift card and go spend all the money on the card. When the customer tries to use the card, it is drained of all value. Even worse, hackers are starting to target gift card websites (auch as described in this story), for instance, using brute-force to check number after number until they find one that is valid and clone a card to match it. That could be your card. To protect yourself, check your cards value immediately after you buy it and then a few days later. If thieves are going to steal your cards value, it will typically be very shortly after you purchase it. Continue to check the balance regularly and spend tham as soon as possible. As soon as you notice some abmormalities, report this to the store where you purchased your card and ask for a replacement. When is a Rebate not a Rebate? When it is a Gift Card (10/24/09) As reported in this story, and increasing trend is to give consumers gift cards instead of rebate checks for mail-in rebates. The retailer wins twice because (a) only about 40% of mail-in rebates are ever mailed in, and (b) most people don't use up the full value of their gift cards; normally 10% of the value on gift cards is left on the table. Colorado and Unclaimed Gift Cards (10/18/09) As States started to realize that unclaimed gift cards were enriching companies bottom lines, many if not most of them passed laws that allowed them to drag that money into their own coffers via unclaimed property laws. Colorado has tried to legitimizes their efforts by allowing people to get that money back by looking up their gift card on the State's unclaimed property website. (article) Of the $13 million Colorado recently pulled in in unclaimed gift card dollars, our expectation is that people will claim less than 0.1%. The great legislators and administrators of Colorado must undoubtedly realize this. Why We Let Gift Cards go to Waste (10/12/09) Here is an interesting article that look at when a gift card expires to how likely we are to spend it vs let it go to waste. Gift Card Spending (10/9/09) According to a recent report, the holiday outlook for gift cards spending is flat to down 5%. At $24 billion for just the holiday season, that is still a lot. The good news is that people are focusing more on using gift cards for essentials; hopefully this means that they are also keeping better track of their gift cards and remembering to spend them. It would be great of gift card breakage (what doesn't get spend by consumers each year and issuers get to keep eventually - around 10% of the face value) goes down significantly. Prepaid Cards & Fees (10/6/09) An interesting article in the New York Times examines (reloadable) prepaid cards and their fees. Issuers of these cards tout them as an alternative to bank accounts and credit cards, especially for those who are unable to get either. Prepaid cards, it turns out, have even higher fees than non-reloadable open-loop gift cards. In one example, the MiCash Prepaid Mastercard has the following impressive roster of fees: $9.95: Activation The industry claims that these cards are cheaper than checking accounts. Many banks offer low balance checking accounts for less than $10. By contrast, even the cheapest prepaid card averaged over $20 per months in fees. Here is a recent Consumers Union report on prepaid cards. Prepaid Card Vendors Cry Boo-Hoo (9/30/09) Vendors that issue reloadable prepaid cards are crying foul over the legislation that will create the new Consumer Financial Protection Agency. They claim that it will make it impossible for anyone but banks to issue the cards. At the heart of their argument is their claim that they help millions of consumers that don't use the banking system or are using these cards are a budgetary tool. This is a load of crap. We've reported before how these type of cards have the highest fees, have very little fraud protection, and don't help customers build credit. While this legislation may be a little wide in its unintended consequenses, it is time someone stepped in to set this industry right. More Reasons to Choose AMEX (9/30/09) Several days ago I posted on an extraordinary customer service experience that one AMEX gift card customer had. Well, today I am seriously feeling the love for AMEX gift cards: They have done away with the monthly fee, effective immediately, for new cards and all existing cards. AMEX fees were already low by open-loop gift cards standards, at $2/month starting 12 months from when the gift card was issued. What makes this even more significant of a move is that this goes above and beyond what AMEX would have had to comply with as part of the new gift cards laws in the Credit Card Reform Act of 2009, which says gift cards may not expire (AMEX cards already didn't expire) and vendors may not charge fees for the first 12 months. AMEX gift cards still carry an up-front purchase fee and may be hard to spend the last few bucks on, but this move makes them the clear leader in value if you are going to buy an open-loop gift cards. Open-Loop Cards vs Rebate Cards (9/29/09) This is interesting. Here is an article that completely hammers what they call "rebate cards." The claim is that companies make rebates incredibly hard to get and by issuing rebate cards instead of checks, they make them hard to spend too. They are so bad in fact that the Canadian government calls them deceptive and has outlawed issuing rebates in cards; rebates in Canada must be sent by check. Why are Canada, the FTC, Attorneys General, Offices of Consumer Affairs and others so down on rebate cards? 1. You can't check the balance except by going to a particular website. Does any of that sound familiar? Rebate cards it turns out are nothing more than open-loop (Visa etc.) preloaded gift/debit cards. Why is it that when these cards are issued as rebates everyone is hopping mad, and yet when they are called gift cards, people are running out to buy them? Open-loop gift cards have been the fastest growing segment of the gift card market for several years. It is an interesting piece of consumer psychology to understand why losing money on a rebate card gets people fuming and yet the many billions more that are lost every year on open-loop gift cards harly raises an eyebrow. Perhaps understanding why people react differently to these two scenarios will help us understand how to get people outraged at the almost smash-and-grab tactics of the gift card issuers that causes consumers to lose so much money every year. Then we might see some meaningful legislation to fix this problem. Virtual Gift Cards (9/29/09) Virtual gift cards aren't new, but this article in the Portland Press is very excited about a new virtual gift card offering by a local company. Bottom line: Virtual gift cards are a bad idea. If you think it is hard to remember to spend a gift card when you have it in your wallet, try remembering to spend them when they are sitting in an email on your computer. Low Denomination Gift Cards (9/29/09) According to this Slate article, retailers sell low value gift cards ($5 or $10) because they know most people will spend more than that when the come in to use the gift card. AMEX Customer Service (9/25/09) I personally think open-loop gift cards are a scam plain and simple. Yet, if you must choose an open-loop gift card, this experience might make you want to (a) always be persistent to get what you are owed and (b) choose AMEX over other the other branded open-loop gift cards. In short, the customer took his $50 AMEX gift card to a store and was unable to use it. He called AMEX customer service on the spot and a half hour on the phone resulted in little help and somewhat of a rude experience. So he wrote a letter to AMEX and they fixed the problem, said they would handle the bad customer service rep internally, and gave him reward points worth another $50 gift card. Kudos to the customer for demanding what he was entitled to and AMEX for stepping up to the plate. As for the other cards, Visa and Mastercard cards are service by many different banks and they all have horrible customer service sites and for some of them it is impossible to get an actual person on the phone. Discover, like AMEX manages its cards directly, but is generally less universally accepted than AMEX. So, if I had to choose an open-loop gift card, I'd probably choose AMEX. Open-Loop Gift Cards & PayPal (9/18/09) Here is a nice little tutorial on how to use an open-loop (Visa/Mastercard/Amex/Discover) gift card with PayPal. A Gift Card Deal I am Actuall Excited About! (9/16/09) I've always liked the idea of the Coinstar machines where you an dump all of your change and get cash; much more productive than counting and rolling it all yourself. But I never wanted to pay the 15% commission for the service. Well now Coinstar will waive the fee if you take your money on a name brand gift card (Amazon.com, Starbucks, etc.) instead of cash. One of the biggest problems with gift cards and the reason why the industry is so profitable, is breakage, where consumers don't use up all the value on their gift cards. But, if you can choose a gift card that you know you will use, then I think it is a great idea. Just for the record, I would choose a Peet's Coffee gift card, if they had one. Perhaps someone will take this idea a step further and sell a gift card that the recipient can use online to pick out a gift card of their choice from a wide range of retailers. I might actually consider giving someone a gift card if that happened. Are the VC's Investing In Their Sleep? (9/15/09) A startup called rackup has developed a new discount gift card site that uses a complicated short and quick auction scheme to sell gift cards at a discount (plus the chance to win an added value bonus). The average discount is 18%. They have apparently managed to attract $3.5 million in funding? Consumers can already get a 15% or better discount on most gift cards at one of the MANY discount gift card sites out there. I'm not sure a complicated auction scheme like this would have a significant appeal to consumers. I suspect this site will dump their auction scheme eventually and turn into an ordinary gift card resale site. Prepaid Cards & Money Laundering (9/12/09) In some ways Gift Cards have not been very well thought out. In particular, they are hard to distinguish from real credit cards, and this can cause problems for merchants. Well, it also causes problems with the governments efforts to fight against money laundering (link and link) because 1) it is not illegal under the current US law to transport more than $10,000 in value on a stored value card across the US border, as it is with other valuables such as cash, precious metals, or gems, and 2) even if it were illegal, border patrol agents have no way to tell how much is on a card. According to a recent article from the Wall Street Journal, prepaid card issues are claiming that new regulations will drive away legitimate business and drive up fees for users. For an industry that is practically minting money in fees, I find this very hard to believe. However, if this does happen, it would likely drive people away from open-loop gift and prepaid cards, which would be a good thing as they are the most costly of all gift and prepaid cards. Where NOT To Buy Gift Cards Second Hand (9/10/09) It is never a good idea to buy something from Criagslist that you can not verify on the spot. Gift cards are no different, as evidenced by a recent sting against two individuals selling bogus amusement park gift cards. Consumer's Union Weighs In on Prepaid Cards (9/10/09) Prepaid cards are essentially open-loop gift cards without the word "gift" on them and are often marketed as a viable alternative to a bank account. Wal-Mart recently announced that it will be paying employees through prepaid debit cards instead of direct deposit. Consumers Union decided to weigh in on the topic and has published an in-depth review of prepaid cards; it isn't pretty. But of course, if you've read any of the other information published here about open-loop gift cards, you already guessed that. The bottom line is prepaid cards are chock full of fees, do nothing to help someone build credit, and have inadequate protection against loss. Another Way to Look at All-Access Gift Cards (8/23/09) To get a better idea the value lifespan of an All-Access Visa gift card, one of the most highly reviled and complained about gift cards due to their very short no-fee period and their very high ($4.95 monthly fee), it is helpful to graph the value left on the card over time.

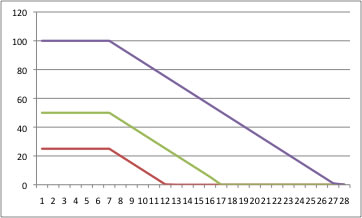

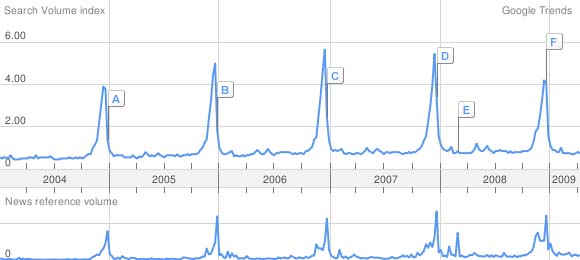

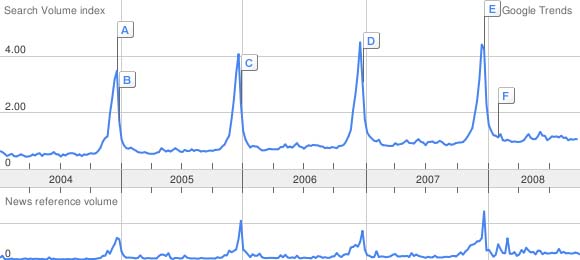

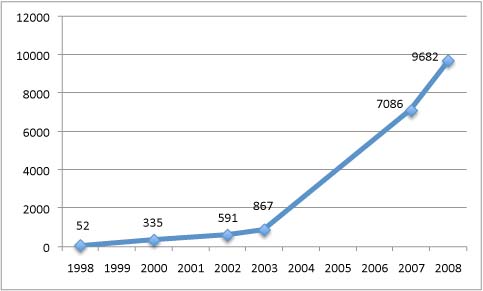

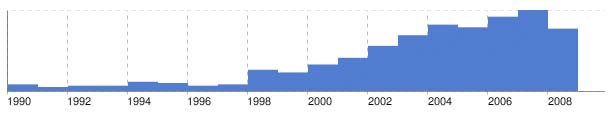

A $25 gift card will be worthless after 12 months, a $50 gift card after 17 months, and a $100 gift card after 27 months. If All-Access showed a graph like this on their gift card packaging, people wouldn't be so excited to buy their cards. Perhaps the above images should be incorporated into the All-Access logo. :) Starbucks Decides to Play Fair (8/22/09) Apparently, Starbucks has not been abiding by the provisions of Californias gift card law in effect since January 2008; they haven't been redeeming balances below $10 on gift cards for cash on request. However, they now claim that they are taking steps to train staff appropriately and add a redemption button to their cash registers to make the process easier. Just a subtle reminder, if you live in California, or your state has a law that requires retailers to retredeem small gift card balances in cash, stand up for your rights! (story) Merchants and Open-Loop Gift Cards (8/18/09) I've paid enough attention to know that, while open-loop gift cards (Visa, Mastercard, etc.) may be a rip off, you shoulldn't be too concerned about the cards being hacked, which is actually a big problem with store-specific gift cards. With close-loop/store specific cards, hackers often scan the cards in-store to get the numbers, wait for them to be activated, and then create a phony card with the just acticated information to drain the cards value (i.e. purchase things) before the customer knows anything is wrong. Because open-loop cards are so well packaged, they aren't prone to this type of hacking. However, as a merchant, I would be VERY worried about accepting open-loop cards. Hardly a week goes by without one or two stories about scams involving gift cards that are hacked to contain stolen credit card information. Thieves then use then use them as gift cards while the charges come from a stolen credit card. It is not too hard to imagine that the stories in the news represent just a fraction of the cases of this kind of fraud. Often times, banks and credit card processors hold merchants responsible for any fraud that passes through their credit card machines, which can be a huge liability. From experience, I know that it is incredibly hard to distinguish between gift cards and credit cards just from the card numbers. If Visa and Mastercard and the likes have a way to tell the difference betwen gift cards and credit cards, they aren't giving merchants the benefit of this information. I suspect the only way to tell is through the merchant network, meaning that the issuing banks database can identify which numbers represent gift cards and which represent credit cards. The current merchant processing interfaces do not include any information which might help. It is quite possible that providing such information might not be possible without redesigning the merchant processing sytem, which might break much of the existing hardware and software. There have been major class-action lawsuits by merchants against the card networks for making merchants swallow the fraud. As gift card/credit card fraud becomes more prevalent, the Visas and Mastercards of the world may be forced to address this by altering their systems to distinguish between gift cards and credit cards, lest they be forced to swallow the fraud themselves. Update 8/26/09: If you are a merchant, you can protect yourself against this kind of fraud by checking the last 4 digits on the card against those printed on the receipt. If they don't match up, you've got an altered gift card. Great Example (8/18/09) This blog post in the Baltimore Sun is a great example of a concerned consumer researching the law related to gift cards in their state, verifying the law with the relevant authorities, and then contacting the issue of the gift certificate to educate them on the law and make sure their gift certificate was treated as it should be. The point is, don't just roll over if you think you are being treated unfairly or what a business is doing is against the law. Stand up for your rights! Gift Card Industry Complains About New Consumer Rules (7/20/09) According to this WSJ article, gift card industry is not happy about a the latest Treasury Department proposal for a US consumer watchdog agency. Specifically, they don't like the proposed rule giving power to State's laws in cases where they are more powerful than Federal laws. The new breed of gift card laws will hit the cash cow open-loop cards (Visa, Mastercard) particular hard as they have been almost minting money with their high fees. Donate Your Unwanted Gift Cards (7/9/09) GiftCardsAgain.com has launched a companion site GiftCardDonor.com that you can use to donate gift cards to one of their (limited) listed charities. They sell the card on GiftCardAgain.com and donate 75% of the proceeds to the charity. A better option might be simply to mail the cards to a charity of your choice with a nice card telling them how much you appreciate what they are doing. Only Buy iTunes Gift Cards from Apple (7/3/09) As a Mac owner, I've found Apple to be not very forthcoming when there are problems and unreasonable at times with their policies. This seems to be the tact there are taking with fraudulent iTunes gift cards, whether they were generated by people who hacked the algorithm or bought with stolen credit cards. If you use such a gift card on your iTunes account, you risk Apple closing your account and losing access to all your purchased music. The best idea is to stay away from iTunes gift cards on the secondary market. (article) State vs Federal Gift Card Laws (6/30/09) Another article in Today's Wall Street Journal (States Get More Power to Challenge National Banks) might effect gift cards in the future. The issue is a Supreme Court rulling on Monday that partially overturns Federal rules on Bank regulation, allowing States procecutors to go after Federally chartered banks for violating certain fair lending practices. With respect to gift cards, Federally chartered banks have used the excuse that they are only regulated by the Federal government to thwart efforts by States to apply gift card laws to them. While this ruling doesn't currently give States the power to go after banks in violation of their gift card laws, it is possibly a step in that direction. Cash for Gift Cards on the Spot (6/30/09) It isn't clear exactly what the cash-in rates or for gift cards but Swapagift.com (part of GiftCards.com) has 600 partner locations where you can bring your gift cards and get cash on the spot. They take many open and closed loop gift cards. (story) States Swallow Unused Gift Cards (6/30/09) I saw this article in the Wall Street Journal today and was going to write a piece on it when I came across such a bit from cato-at-liberty.org: Posted by Mark A. Calabria Little noticed in the recently enacted credit card bill was a provision prohibiting retailers and financial institutions from issuing gift cards that expired with a set time, except under certain circumstances. While card issuers had been using expiration dates to estimate and manage their liabilities, many States had been “collecting” the value of these unused cards as “abandoned property”, as discussed in today’s Wall Street Journal. Some states have even been going after cards with no expiration date, arguing that if you leave that gift card sitting around your house or in your wallet for too long, then you’ve abandoned. What’s next, funds sitting unused in your bank account will next be considered abandoned. The States that require unused gift cards, or unused portions, to be turned over require retailer and card processors to maintain databases tracking card amounts and usage. There is some comfort, however, in knowing that some States do allow you to re-claim your “abandoned gift dollars,” for instance of the $9.6 million collected by New York State last year in unused gift cards, rightful owners were able to recover $2,150. Clearly the States' motives are suspect here when a state such as New York, under the guise of protecting consumers rights is able to return only 0.02% of funds they confiscated. The Risk of Reloadable Prepaid Cards 6/25/09) The Wall Street Journal has an article (WSJ - A Push to Regulate Prepaid Cards) about the risks associated with reloadable prepaid debit/gift cards, namely that they aren't subject to the Credit Card Act of 2009 and such cards aren't required to offer protections against fraud. If fraudulent charges appear on your reloadable prepaid debit card, you essentially may have no recourse as any fraud protection offered is voluntary for the issuer. What is most shocking however in this article is the report on the total size of the prepaid market - between $39 billion and $119 billion in transactions in 2007. (Seriously, a range this big makes me wonder if they have any clue as to the market size. This is like someone specifying their age as between 24 and 56 on Match.com rather than saying they are in their 40's.) Numbers that large clearly aren't part of the estimates of the overall "gift" card market of $90 billion/year. It is also shocking that such a large volume of transactions isn't covered by the recent credit/gift card legislation. Prepaid Cards (6/16/09) I came across this handy summary of prepaid debit and gift cards. The author makes a very valid point; even when you've managed to spend the last dime on your prepaid card, you may not want to get rid of it. In the case where you return something that was purchased using your prepaid card, it will likely go back on the card. If you don't have the card, your money is lost. Unused Gift Cards (6/6/09) I've seen plenty of estimates of how much of total gift card sales gets left on the table by consumers each year ($8-10 billion), but I've never seen someone give a number for the TOTAL in gift card value that sits unused. An article in Business Week (here) says that there is about $40 billion in unused gift cards sitting out there. When are Gift Cards Like Cash? (6/2/09) In most cases gift cards should not be thought of as cash - they tend to lose value quickly, and you often can't spend the last few bucks on your card. However, there is one case where you should think of them as cash - when you send them through the mail. Every week I see stories about Postal employees being busted for stealing gift cards from the mail. If you do want to send gift cards through the Postal mail, don't make them look like gift cards. Federal Credit Card Laws Including Gift Card Provisions Signed Into Law (5/22/09) President Obama has signed the Credit Card Reform Act into law. For a breakdown of how it affects gift cards, see here and here. The new rules won't take effect until February of 2010. One of the most overlooked features of the law is that the Federal Reserve now has jurisdiction over gift cards, meaning it can set how high fees can be and such. First Venture Funding for Gift Card Site (5/21/09) The recent Series A funcing round of $4.8 million that Plasic Jungle just scored from the likes of Shast Ventures, Bay Partners, and First Round Capital is the first such investment in a gift card site that I've seen. (article) Even More Gift Card Laws in the Works (5/20/09) As we reported below (4/30/09 story with updates), congress passed the credit card reform act which includes curbs on gift card expiration and fees. There is other legislation (not yet a bill) making its way through congress that deals with the interchange aspects of credit cards and includes even more possible gift card legislation. The central theme in this legislation is the desire for merchants to not be penalized for offering cash prices below credit prices. One possible effect for gift cards is the ability for states to pass gift card legislation stricter than the Federal legislation. (article) Gift Cards Not Covered by Laws On Transporting Money Across U.S. Border (5/18/09) This article about how drug cartels just love gift cards points out something I never knew before: Gift cards are not covered by the law the prevents a person from taking more than $10,000 either into or out of the United States without reporting it. How Companies Side Step Gift Card Laws (5/3/09) How does Ticketmaster get around honoring an expired gift card even though California has a law that says gift cards can never expire? They call it a "discount card," despite the fact that the card says "Gift Card" right on it. (story) We can undoubtedly expect more of these shenanigans as more gift card laws get passed. Federal Legislation Related to Gift Cards (4/30/09) According to this summary and this article of the proposed new Federal laws governing credit cards that are now working their way through the House(H.R. 627) and Senate (S.414), at least one of the proposed laws "protects gift cards from most inactivity fees." How it does so doesn't appear clear to me from the text of the bill. A Federal law governing gift cards would be a HUGE advancement towards the reasonable legislation of some of the rediculous fees associated with some gift cards. We can only hope that since these bills deal with credit cards, any proposed gift card laws will apply to open-loop (Visa) cards as well as closed-loop ones. There is another version of the Fair Gift Card Act (S.710) making its way through Congress as well, again introduced by Senators Schumer and Udall. There has been virtually NO press coverage on this bill. This bill DOES apply to both open and closed loop gift cards! In short, the Fair Gift Card Act specifies - Cards may not expire in less than 5 years - No dormancy, inactivity, or service fees except under very restrictive circumstances - The Federal laws do not supercede any State laws related to gift card expirations and fees. UPDATE 5/6/09: The gift card provision of the Senate bill is apparently one of the sticking points in rectifying the credit card legislation House and Senate bills. (article) Update 5/18/09: The Senate passed a version of S.414 that still includes the gift card provisions stated above. The next step is for the Senate and the House to hash out a compromise bill between their two versions. Whether the gift card provisions make it in is anyones guess. (article) Update 5/20/09: The Senate version of the bill has passed the House and been sent to President Obama for signing. Looks like the gift card provisions are still in it! Google Trends 4/20/09 Google Trends is a nifty tool that allows you to see the relatve frequency with which a search term appears historically in Google searches. Google Trends shows this frequency map for the term "gift cards"