Here is an interesting article that look at when a gift card expires to how likely we are to spend it vs let it go to waste.

According to a recent report, the holiday outlook for gift cards spending is flat to down 5%. At $24 billion for just the holiday season, that is still a lot. The good news is that people are focusing more on using gift cards for essentials; hopefully this means that they are also keeping better track of their gift cards and remembering to spend them. It would be great of gift card breakage (what doesn’t get spend by consumers each year and issuers get to keep eventually – around 10% of the face value) goes down significantly.

An interesting article in the New York Times examines (reloadable) prepaid cards and their fees. Issuers of these cards tout them as an alternative to bank accounts and credit cards, especially for those who are unable to get either. Prepaid cards, it turns out, have even higher fees than non-reloadable open-loop gift cards. In one example, the MiCash Prepaid Mastercard has the following impressive roster of fees:

$9.95: Activation

$1.75: ATM withdrawl

$1.00: ATM balance inquiry

$0.50: Per purchase

$4.00: Monthly maintenance

$2.00: Inactivity per month after 60 days

$1.00: Call to customer service

The industry claims that these cards are cheaper than checking accounts. Many banks offer low balance checking accounts for less than $10. By contrast, even the cheapest prepaid card averaged over $20 per months in fees.

Here is a recent Consumers Union report on prepaid cards.

Vendors that issue reloadable prepaid cards are crying foul over the legislation that will create the new Consumer Financial Protection Agency. They claim that it will make it impossible for anyone but banks to issue the cards. At the heart of their argument is their claim that they help millions of consumers that don’t use the banking system or are using these cards are a budgetary tool.

This is a load of crap. We’ve reported before how these type of cards have the highest fees, have very little fraud protection, and don’t help customers build credit. While this legislation may be a little wide in its unintended consequences, it is time someone stepped in to set this industry right.

Several days ago I posted on an extraordinary customer service experience that one AMEX gift card customer had. Well, today I am seriously feeling the love for AMEX gift cards: They have done away with the monthly fee, effective immediately, for new cards and all existing cards. AMEX fees were already low by open-loop gift cards standards, at $2/month starting 12 months from when the gift card was issued.

What makes this even more significant of a move is that this goes above and beyond what AMEX would have had to comply with as part of the new gift cards laws in the Credit Card Reform Act of 2009, which says gift cards may not expire (AMEX cards already didn’t expire) and vendors may not charge fees for the first 12 months.

AMEX gift cards still carry an up-front purchase fee and may be hard to spend the last few bucks on, but this move makes them the clear leader in value if you are going to buy an open-loop gift cards.

This is interesting. Here is an article that completely hammers what they call “rebate cards.” The claim is that companies make rebates incredibly hard to get and by issuing rebate cards instead of checks, they make them hard to spend too. They are so bad in fact that the Canadian government calls them deceptive and has outlawed issuing rebates in cards; rebates in Canada must be sent by check.

Why are Canada, the FTC, Attorneys General, Offices of Consumer Affairs and others so down on rebate cards?

1. You can’t check the balance except by going to a particular website.

2. You can’t tell how much is left at the point of sale.

3. It is very difficult to use the card as well as another form of payment for a single purchase

4. It is nearly impossibly to spend all the money on the card.

5. The cards additionally carry onerous fees.

6. The terms of the card were not fully disclosed at the time of issue.

Does any of that sound familiar? Rebate cards it turns out are nothing more than open-loop (Visa etc.) preloaded gift/debit cards.

Why is it that when these cards are issued as rebates everyone is hopping mad, and yet when they are called gift cards, people are running out to buy them? Open-loop gift cards have been the fastest growing segment of the gift card market for several years.

It is an interesting piece of consumer psychology to understand why losing money on a rebate card gets people fuming and yet the many billions more that are lost every year on open-loop gift cards harly raises an eyebrow. Perhaps understanding why people react differently to these two scenarios will help us understand how to get people outraged at the almost smash-and-grab tactics of the gift card issuers that causes consumers to lose so much money every year. Then we might see some meaningful legislation to fix this problem.

Virtual gift cards aren’t new, but this article in the Portland Press is very excited about a new virtual gift card offering by a local company.

Bottom line: Virtual gift cards are a bad idea. If you think it is hard to remember to spend a gift card when you have it in your wallet, try remembering to spend them when they are sitting in an email on your computer.

According to this Slate article, retailers sell low value gift cards ($5 or $10) because they know most people will spend more than that when the come in to use the gift card.

I personally think open-loop gift cards are a scam plain and simple. Yet, if you must choose an open-loop gift card, this experience might make you want to (a) always be persistent to get what you are owed and (b) choose AMEX over other the other branded open-loop gift cards.

In short, the customer took his $50 AMEX gift card to a store and was unable to use it. He called AMEX customer service on the spot and a half hour on the phone resulted in little help and somewhat of a rude experience. So he wrote a letter to AMEX and they fixed the problem, said they would handle the bad customer service rep internally, and gave him reward points worth another $50 gift card. Kudos to the customer for demanding what he was entitled to and AMEX for stepping up to the plate.

As for the other cards, Visa and Mastercard cards are service by many different banks and they all have horrible customer service sites and for some of them it is impossible to get an actual person on the phone. Discover, like AMEX manages its cards directly, but is generally less universally accepted than AMEX. So, if I had to choose an open-loop gift card, I’d probably choose AMEX.

Here is a nice little tutorial on how to use an open-loop (Visa/MasterCard/Amex/Discover) gift card with PayPal.

A startup called rackup has developed a new discount gift card site that uses a complicated short and quick auction scheme to sell gift cards at a discount (plus the chance to win an added value bonus). The average discount is 18%. They have apparently managed to attract $3.5 million in funding?

Consumers can already get a 15% or better discount on most gift cards at one of the MANY discount gift card sites out there. I’m not sure a complicated auction scheme like this would have a significant appeal to consumers.

I suspect this site will dump their auction scheme eventually and turn into an ordinary gift card resale site.

But then again, the very fact that consumers spend so much money on an obviously deficient product (gift cards) probably means that many of them will play this silly bidding game thinking they are getting a great deal, when in fact they are not.

In some ways Gift Cards have not been very well thought out. In particular, they are hard to distinguish from real credit cards, and this can cause problems for merchants. Well, it also causes problems with the governments efforts to fight against money laundering (link and link) because 1) it is not illegal under the current US law to transport more than $10,000 in value on a stored value card across the US border, as it is with other valuables such as cash, precious metals, or gems, and 2) even if it were illegal, border patrol agents have no way to tell how much is on a card.

According to a recent article from the Wall Street Journal, prepaid card issues are claiming that new regulations will drive away legitimate business and drive up fees for users. For an industry that is practically minting money in fees, I find this very hard to believe. However, if this does happen, it would likely drive people away from open-loop gift and prepaid cards, which would be a good thing as they are the most costly of all gift and prepaid cards.

It is never a good idea to buy something from Criagslist that you can not verify on the spot. Gift cards are no different, as evidenced by a recent sting against two individuals selling bogus amusement park gift cards.

Prepaid cards are essentially open-loop gift cards without the word “gift” on them and are often marketed as a viable alternative to a bank account. Wal-Mart recently announced that it will be paying employees through prepaid debit cards instead of direct deposit.

Consumers Union decided to weigh in on the topic and has published an in-depth review of prepaid cards; it isn’t pretty. But of course, if you’ve read any of the other information published here about open-loop gift cards, you already guessed that. The bottom line is prepaid cards are chock full of fees, do nothing to help someone build credit, and have inadequate protection against loss.

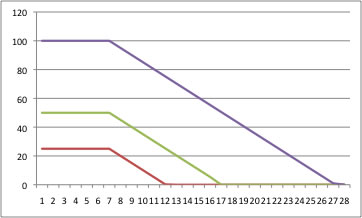

To get a better idea the value lifespan of an All-Access Visa gift card, one of the most highly reviled and complained about gift cards due to their very short no-fee period and their very high ($4.95 monthly fee), it is helpful to graph the value left on the card over time.

A $25 gift card will be worthless after 12 months, a $50 gift card after 17 months, and a $100 gift card after 27 months.

If All-Access showed a graph like this on their gift card packaging, people wouldn’t be so excited to buy their cards.

Perhaps the above images should be incorporated into the All-Access logo. :)

Apparently, Starbucks has not been abiding by the provisions of California’s gift card law in effect since January 2008; they haven’t been redeeming balances below $10 on gift cards for cash on request. However, they now claim that they are taking steps to train staff appropriately and add a redemption button to their cash registers to make the process easier.

Just a subtle reminder, if you live in California, or your state has a law that requires retailers to redeem small gift card balances in cash, stand up for your rights! (story)

I’ve paid enough attention to know that, while open-loop gift cards (Visa, MasterCard, etc.) may be a rip off, you shouldn’t be too concerned about the cards being hacked, which is actually a big problem with store-specific gift cards. With close-loop/store specific cards, hackers often scan the cards in-store to get the numbers, wait for them to be activated, and then create a phony card with the just activated information to drain the cards value (i.e. purchase things) before the customer knows anything is wrong. Because open-loop cards are so well packaged, they aren’t prone to this type of hacking.

However, as a merchant, I would be VERY worried about accepting open-loop cards. Hardly a week goes by without one or two stories about scams involving gift cards that are hacked to contain stolen credit card information. Thieves then use then use them as gift cards while the charges come from a stolen credit card. It is not too hard to imagine that the stories in the news represent just a fraction of the cases of this kind of fraud.

Often times, banks and credit card processors hold merchants responsible for any fraud that passes through their credit card machines, which can be a huge liability.

From experience, I know that it is incredibly hard to distinguish between gift cards and credit cards just from the card numbers. If Visa and MasterCard and the likes have a way to tell the difference between gift cards and credit cards, they aren’t giving merchants the benefit of this information. I suspect the only way to tell is through the merchant network, meaning that the issuing banks database can identify which numbers represent gift cards and which represent credit cards. The current merchant processing interfaces do not include any information which might help. It is quite possible that providing such information might not be possible without redesigning the merchant processing system, which might break much of the existing hardware and software.

There have been major class-action lawsuits by merchants against the card networks for making merchants swallow the fraud. As gift card/credit card fraud becomes more prevalent, the Visas and MasterCards of the world may be forced to address this by altering their systems to distinguish between gift cards and credit cards, lest they be forced to swallow the fraud themselves.

Update 8/26/09: If you are a merchant, you can protect yourself against this kind of fraud by checking the last 4 digits on the card against those printed on the receipt. If they don’t match up, you’ve got an altered gift card.

This blog post in the Baltimore Sun is a great example of a concerned consumer researching the law related to gift cards in their state, verifying the law with the relevant authorities, and then contacting the issuer of the gift certificate to educate them on the law and make sure their gift certificate was treated as it should be.

The point is, don’t just roll over if you think you are being treated unfairly or what a business is doing is against the law. Stand up for your rights! If everyone demanded compliance with gift card laws, issuers would have no choice but to comply.

According to this WSJ article, gift card industry is not happy about a the latest Treasury Department proposal for a US consumer watchdog agency. Specifically, they don’t like the proposed rule giving power to State’s laws in cases where they are more powerful than Federal laws.

The new breed of gift card laws will hit the cash cow open-loop cards (Visa, Mastercard) particular hard as they have been almost minting money with their high fees.

GiftCardsAgain.com has launched a companion site GiftCardDonor.com that you can use to donate gift cards to one of their (limited) listed charities. They sell the card on GiftCardAgain.com and donate 75% of the proceeds to the charity. A better option might be simply to mail the cards to a charity of your choice with a nice card telling them how much you appreciate what they are doing.

RSS