As a Mac owner, I’ve found Apple to be not very forthcoming when there are problems and unreasonable at times with their policies. This seems to be the tact there are taking with fraudulent iTunes gift cards, whether they were generated by people who hacked the algorithm or bought with stolen credit cards. If you use such a gift card on your iTunes account, you risk Apple closing your account and losing access to all your purchased music. The best idea is to stay away from iTunes gift cards on the secondary market. (article)

Another article in Today’s Wall Street Journal (States Get More Power to Challenge National Banks) might effect gift cards in the future. The issue is a Supreme Court rulling on Monday that partially overturns Federal rules on Bank regulation, allowing States procecutors to go after Federally chartered banks for violating certain fair lending practices. With respect to gift cards, Federally chartered banks have used the excuse that they are only regulated by the Federal government to thwart efforts by States to apply gift card laws to them. While this ruling doesn’t currently give States the power to go after banks in violation of their gift card laws, it is possibly a step in that direction.

It isn’t clear exactly what the cash-in rates or for gift cards but Swapagift.com (part of GiftCards.com) has 600 partner locations where you can bring your gift cards and get cash on the spot. They take many open and closed loop gift cards. (story)

I saw this article in the Wall Street Journal today and was going to write a piece on it when I came across such a bit from cato-at-liberty.org:

Posted by Mark A. Calabria

Little noticed in the recently enacted credit card bill was a provision prohibiting retailers and financial institutions from issuing gift cards that expired with a set time, except under certain circumstances. While card issuers had been using expiration dates to estimate and manage their liabilities, many States had been “collecting” the value of these unused cards as “abandoned property”, as discussed in today’s Wall Street Journal.

Some states have even been going after cards with no expiration date, arguing that if you leave that gift card sitting around your house or in your wallet for too long, then you’ve abandoned. What’s next, funds sitting unused in your bank account will next be considered abandoned. The States that require unused gift cards, or unused portions, to be turned over require retailer and card processors to maintain databases tracking card amounts and usage.

There is some comfort, however, in knowing that some States do allow you to re-claim your “abandoned gift dollars,” for instance of the $9.6 million collected by New York State last year in unused gift cards, rightful owners were able to recover $2,150.

Clearly the States’ motives are suspect here when a state such as New York, under the guise of protecting consumers rights is able to return only 0.02% of funds they confiscated.

The Wall Street Journal has an article (WSJ – A Push to Regulate Prepaid Cards) about the risks associated with reloadable prepaid debit/gift cards, namely that they aren’t subject to the Credit Card Act of 2009 and such cards aren’t required to offer protections against fraud. If fraudulent charges appear on your reloadable prepaid debit card, you essentially may have no recourse as any fraud protection offered is voluntary for the issuer.

What is most shocking however in this article is the report on the total size of the prepaid market – between $39 billion and $119 billion in transactions in 2007. (Seriously, a range this big makes me wonder if they have any clue as to the market size. This is like someone specifying their age as between 24 and 56 on Match.com rather than saying they are in their 40’s.) Numbers that large clearly aren’t part of the estimates of the overall “gift” card market of $90 billion/year. It is also shocking that such a large volume of transactions isn’t covered by the recent credit/gift card legislation.

I came across this handy summary of prepaid debit and gift cards. The author makes a very valid point; even when you’ve managed to spend the last dime on your prepaid card, you may not want to get rid of it. In the case where you return something that was purchased using your prepaid card, it will likely go back on the card. If you don’t have the card, your money is lost.

I’ve seen plenty of estimates of how much of total gift card sales gets left on the table by consumers each year ($8-10 billion), but I’ve never seen someone give a number for the TOTAL in gift card value that sits unused. An article in Business Week (here) says that there is about $40 billion in unused gift cards sitting out there.

In most cases gift cards should not be thought of as cash – they tend to lose value quickly, and you often can’t spend the last few bucks on your card. However, there is one case where you should think of them as cash – when you send them through the mail. Every week I see stories about Postal employees being busted for stealing gift cards from the mail. If you do want to send gift cards through the Postal mail, don’t make them look like gift cards.

President Obama has signed the Credit Card Reform Act into law. For a breakdown of how it affects gift cards, see here and here. The new rules won’t take effect until February of 2010. One of the most overlooked features of the law is that the Federal Reserve now has jurisdiction over gift cards, meaning it can set how high fees can be and such.

The recent Series A funcing round of $4.8 million that Plasic Jungle just scored from the likes of Shast Ventures, Bay Partners, and First Round Capital is the first such investment in a gift card site that I’ve seen. (article)

As we reported below (4/30/09 story with updates), congress passed the credit card reform act which includes curbs on gift card expiration and fees. There is other legislation (not yet a bill) making its way through congress that deals with the interchange aspects of credit cards and includes even more possible gift card legislation. The central theme in this legislation is the desire for merchants to not be penalized for offering cash prices below credit prices. One possible effect for gift cards is the ability for states to pass gift card legislation stricter than the Federal legislation. (article)

This article about how drug cartels just love gift cards points out something I never knew before: Gift cards are not covered by the law the prevents a person from taking more than $10,000 either into or out of the United States without reporting it.

How does Ticketmaster get around honoring an expired gift card even though California has a law that says gift cards can never expire? They call it a “discount card,” despite the fact that the card says “Gift Card” right on it. (story)

We can undoubtedly expect more of these shenanigans as more gift card laws get passed.

According to this summary and this article of the proposed new Federal laws governing credit cards that are now working their way through the House(H.R. 627) and Senate (S.414), at least one of the proposed laws “protects gift cards from most inactivity fees.” How it does so doesn’t appear clear to me from the text of the bill. A Federal law governing gift cards would be a HUGE advancement towards the reasonable legislation of some of the rediculous fees associated with some gift cards. We can only hope that since these bills deal with credit cards, any proposed gift card laws will apply to open-loop (Visa) cards as well as closed-loop ones.

There is another version of the Fair Gift Card Act (S.710) making its way through Congress as well, again introduced by Senators Schumer and Udall. There has been virtually NO press coverage on this bill. This bill DOES apply to both open and closed loop gift cards!

In short, the Fair Gift Card Act specifies

– Cards may not expire in less than 5 years

– No dormancy, inactivity, or service fees except under very restrictive circumstances

– The Federal laws do not supercede any State laws related to gift card expirations and fees.

UPDATE 5/6/09: The gift card provision of the Senate bill is apparently one of the sticking points in rectifying the credit card legislation House and Senate bills. (article)

Update 5/18/09: The Senate passed a version of S.414 that still includes the gift card provisions stated above. The next step is for the Senate and the House to hash out a compromise bill between their two versions. Whether the gift card provisions make it in is anyones guess. (article)

Update 5/20/09: The Senate version of the bill has passed the House and been sent to President Obama for signing. Looks like the gift card provisions are still in it!

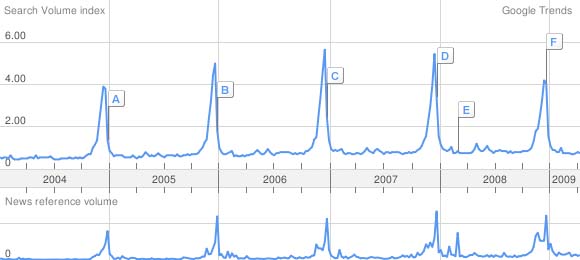

Google Trends is a nifty tool that allows you to see the relatve frequency with which a search term appears historically in Google searches. Google Trends shows this frequency map for the term “gift cards”

This pretty much tells us what we alrady know, gift cards are HUGELY a holiday phenomonon and have been steadily growing. Notice however that over the last holiday season, less overall searches for gift cards. The three other smaller spikes that have appears in the last four years look suspiciously like Valentines day, Mother’s Day, and Father’s day.

US Bank recently announced that it is the number one issuer of Visa branded gift cards. An analysis of their gift card fees shows that they are even worse than everyone’s least favorite gift card, the All-Access gift card. The US Bank Visa gift card starts charging a $2.50 monthly fee ONLY six months after issuance, charges $0.50 for every call (after the first two) to the AUTOMATED balance check number, strictly prohibits resale of US Bank gift cards (huh?), and charges $15 to replace a lost or stolen gift card.

Is it just me, or are gift card companies getting even more brazen with their high fees? Perhaps they feel that because they have escaped regulation thus far, anything goes.

I’ve always liked the idea of the Coinstar machines where you an dump all of your change and get cash; much more productive than counting and rolling it all yourself. But I never wanted to pay the 15% commission for the service. Well now Coinstar will waive the fee if you take your money on a name brand gift card (Amazon.com, Starbucks, etc.) instead of cash. One of the biggest problems with gift cards and the reason why the industry is so profitable, is breakage, where consumers don’t use up all the value on their gift cards. But, if you can choose a gift card that you know you will use, then I think it is a great idea.

Perhaps someone will take this idea a step further and sell a gift card that the recipient can use online to pick out a gift card of their choice from a wide range of retailers. I might actually consider giving someone a gift card if that happened.

Apparently, the gift card industry doesn’t think it is making enough profits. (article) I think most gift card users would disagree. However, one thing is clear, open-loop general-purpose Visa and Mastercard type gift cards are the most profitable segment of the industry.

The Senate is considering a bill to tighten regulations on credit cards. Among the provisions is one that would prohibit gift cards from expiring in less than five years from the date of issue as well as significantly limit dormancy fees. This legilslation, introuced by Senators Charles Schumer and Mark Udall, is similar to legislation Schumer has been trying to get passed since 2004. There is no indication at this time whether the law would apply to both open and closed loop gift cards. (article & article)

Sounds good, doesn’t it? GiftCards.com recently announced, as a gesture to help people for whom every buck counts, a gift card that has no montly fee. Their normal gift cards come with plenty of fees, including a per-transaction fee, ATM fee, international use fee, and even a fee to change your PIN number. The new montly feeless NMF Visa gift card, while it has no montly fee (until the expiration date passes), seems to make up for it in other ways, including a higher per-transaciton fee, a $15 expiration fee (that is assessed when your card expires), and a higher issuance fee. It also isn’t clear from the language in the press release and the cards terms & conditions, but it appears that the NMF card expires after only one year, unlike their normal cards that expire after 2 years.

Not such a good deal after all.

One of these days I’m going to survey every open-loop gift card I can find to figure out which one of them is the best, or most likely in the realm of gift cards, the least worst.

RSS