Illnois has a new gift card law that takes effect on Jan 1st, 2009 and requires that gift cards last for a minimum of 5 years and bans non-use fees. The new law applies only to gift cards purchased on or after Jan 1, 2009. Like every other gift card law, it does not apply to general purpose (open-loop) gift cards. (article)

Technically, this isn’t related to gift cards. But, in the cheesy shenanigan department, gift cards kind of remind me of another classic cheesy scam, mail-in rebates. Mail-in rebate processors are more slippery than health insurance companies, if that is possible. Well, things in the mail-in rebate department just got a lot worse as one of the large mail-in rebate processors just filed for chapter 11 (story). Try getting your rebate now!

I constantly monitor all kinds of news and blogs for information and articles related to gift cards. These days, a healthy majority of articles are negative and are related to the riskiness of gift cards because of bankruptcies, how much gift cards sales will drop this holiday season, and how gift cards in general are a bad idea because of high fees and such. Is this the end of gift cards? I seriously doubt it. Trends of the last few years show that consumers are oblivious to the negative aspects of gift cards despite gobs of information on how bad some of them are. Surveys are projecting a 6% decrease in gift card sales this holiday season; when you compare that to spending on other things, such as a 30% drop in vehicle sales and the huge drop in sales that many consumer companies are experiencing, you could actually call gift card sales projections pretty strong, relatively speaking.

This is a BIG deal! The FDIC today issued an opinion stating that funds on gift cards and other stored value cards are FDIC insured if they are issued by an FDIC insured bank. (article) To my knowledge, there haven’t been any bank failures that have resulted in gift card holders being left out in the cold, but that seems a very likely scenario given the way things are going.

The FDIC further clarified this order (on 11/25/08) after an NPR news story that said the FDIC backing applies to all gift cards. It doesn’t, just to prepaid cards issued by FDIC backed banks.

Looks like Circuit City will again be accepting its gift cards (article), with the recent court approval of its desire to do so. I think the difference between Circuit City and the other recent bankruptcies that involved large sums of unredeemed gift cards (i.e. Sharper Image and such) is that Circuit City appears to really want to stay in business. It’s a step in the right direction.

Quoted in this article, consumers union recommends that people avoid giving gift cards this holiday season.

Is this where the industry is heading? Sorry, we ate up all your card value with fees but as a consolation your worthless gift card is a camera worse than the one on your phone.

American Express sells a lot of gift cards. Today, according to this article Amex was approved by the Federal Reserve to become a bank holding company. What this means for gift card holders is that there is a new venue to complain about problems with Amex gift cards. As a bank holding company, Amex will be overseen by the Federal Reserve. You can find out more about the Federal Reserve’s consumer compalint process here.

Consumer reports says that 25% of gift cards go unused each year. A commonly accepted breakage value (the amount of gift card value that doesn’t get spent) is 10% of the total amount on gift cards sold each year. For these two numbers to make sense, the cards that go unused must be heavily weighted in the smaller values. Perhaps the psychology behind this is that people are less likely to forget about a gift card with more value on it.

While there are a lot of players in the gift card resale market, most of them are bit players; you can tell by the number of listings for cards they have on their site. One site that appears to be one of the smallish players is MonsterGiftCard.com. I wouldn’t mention them, except they put out a press release about a HUGE 40% increase in sales in one month. Um, a big increase on something small is still something small. Their site still only lists less than 100 gift cards for sale. This huge increase in sales must be the reason their URL is appraised at a whopping $2,000. When I clicked the Update this Data link on their page at Website Outlook, their value went down by about $100 and their daily page views dropped from 598 to 551 from 33 days ago. Hmm. When I checked the data for PlaticJungle.com, one of the leaders in the space, its value and page views went up from two months ago.

A New York appellate court came down hard on Simon Malls gift cards for their poor disclosure of fees, citing among other things fonts sizes smaller than allowed, fee information being buried in the fine print agreements, and for setting fees at grossly excessive amounts. (article)

Maine’s new gift card laws (article), allows anyone to cash out gift cards with a balance of less than $5.

Michigan’s new law (article) states that gift cards must be valid for a minimum of 5 years, issuers may not charge inactivity fees or other service fees, must not alter the gift cards terms & conditions after it is issued, and must not fail to disclose the terms & conditions.

It is unclear whether either of these new laws appy to open-loop (Visa, Mastercard type) gift cards. Most state laws for gift cards do not apply to these type of cards.

A recent article (Old Gift Cards are in Season, WSJ 10/22/08) in the Wall Street Journal places the blame for gift card breakage partially on consumers shoulders for their bad habit of waiting or forgetting to use their gift cards. While I agree that this behavior is clearly common among consumers, I think it is based on a fundamental misunderstanding by consumers in thinking that their gift cards will continue to hold value indefinitely. Perhaps we just think it would be the reasonable thing to do.

The article also notes a trend where consumers are digging deep looking for old gift cards to use up and how this is good news for retailers. While most retailers wait to book profit on sales from gift cards until they are redeemed, they do eventually benefit from unused gift cards when they claim unused balances as breakage.

However, while retailers may benefit when gift cards are used because they can claim profit, they also benefit from the cash flow that unused gift cards provide them. When older gift cards are used, retailers may be able to book a profit, but they don’t get the cash flow from a non-gift card purchase.

The real news is the lack of news. Since I’ve started paying attention to all things gift cards, the general economic meltdown has sucked all the oxygen out of a lot of other news and there has been very little interesting to report lately. Seems people don’t care about their last few bucks on a gift card when their 401k has gotten a serious haircut.

If you find any interesting gift-card related tidbits (and I’m not talking about how Costco is selling Starbucks gift cards 20% off … we’re not that kind of gift card site) please send them our way.

British Columbia has joined Alberta and a number of US states in banning gift card expiration. They also prohibit handling charges or fees except in limited circumstances. As with most such laws, once again open-loop (Visa, Mastercard, etc.) type gift cards are excluded from the new laws. Is it that Visa and Mastercard are such a strong lobbying force, or do lawmakers not fully understand how difficult they are to use up completely? (article)

This guide on eBay is actually a pretty good list of gift card gotchas.

A survey report released recently predicts that the overall spend on gift cards this holiday season will decrease by 5%, that people will be using their gift cards less on frivolous stuff and more on necessities (so far this is all pretty obvious), and that open-loop gift cards (or what they call prepaid bank cards) will be the most desired by recipients due to the fact that they can be used in more places.

By some estimates, open-loop gift cards made up as much as 35% of all gift card purchases in 2007. Could we be headed for 50% for 2008? It will be interesting to see if breakage (the amount of the spend on gift cards that never gets redeemed/spent by consumers) increases or decreases in 2008, and whether or not this can be attributed to the increase in open-loop gift cards being bought. I suspect that open-loop gift cards have a higher breakage rate than closed-loop ones, even though they can be used in more places, because it is so hard to use the last few bucks on them.

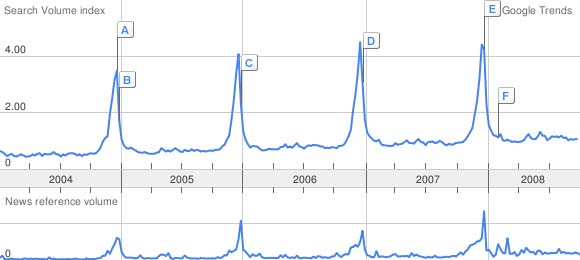

Searching Google Trends for the words “gift card” tells us what we probably already know:

Gift cards are REALLY poplular during the holidays!

This story about a restaurant employee pocketing the cash and then giving customers zero value gift cards sure sounds bad for gift cards. But is it really? How can customers try to redeem $150,000 in invalid gift cards that should have been valid over 9 years and the management not notice that something was going on? Baffling.

The scam played out with Wal-Mart gift cards is a well known one; thieves scan the cards on the rack, wait for them to be activated by checking the Wal-Mart website, and then with card writers, program gift cards with the same info and use them before the purchaser to buy stuff from Wal-Mart, which they then return for cash.

Here is a story about the first time this scan has played out on American Express gift cards. If you have bought Visa, Mastercard, or Amex gift cards from a display at Safeway, Walgreens, etc. they are very well packaged such that you can’t scan the card until the package is opened, so that someone used this scam is a surprise to me. Perhaps the cards were on display without such packaging.

RSS