As I’ve explored the world of gift cards for my own business, I’ve frequented the places where they are sold. The largest selection of gift cards I’ve seen is at grocery stores like Safeway. Until today, I wasn’t aware, but the those displays are called “Gift Card Malls” and are provided by a company called Blackhawk Network, a Safeway subsidiary. Now they will be installing their displays in Staples stores.(article) While I myself am highly suspicious of the gift card industry, I’ll admit that gift cards do have their benefits. The displays at Safeway in particular with their large selection of gift cards are great for some, ahem, last minute holiday or birthday shopping. :)

Just trying to spread the word so more people can find this useful information.

I now count 28 sites on our list of gift card buy/sell/trade/swap/transfer sites.

For the first time in many years, gift card sales are expected to be lower this year. (article)

The province of Alberta, Canada is the latest to ban gift card expiration dates. (article)

Apparently Buy.com had a software glitch in its POS software such that for a while when people payed partly with a gift card and partly with a credit card, it never charged the credit card. So it is charging them now, one or more years later. (article)

I guess you snooze you lose isn’t a legal doctrine.

I can’t make this up:

“According to a new survey from the National Research Network, the perception that gift cards are impersonal is the top inhibitor for consumers purchasing gift cards …” (article here).

With over $90 Billion in US gift card sales last year, the industry doesn’t seem very inhibited. As a matter of fact, lots of people I know LIKE the fact that they are anonymous.

I recently ran across an article in the Washington Post from February of 2006. The article talks about how difficult it is to use up small amounts left on Visa and MasterCard Gift Cards. A couple of quotes from the article caught my eye:

“Visa spokeswoman Rhonda Bentz said the company was unaware of the problem of split transactions until The Washington Post raised the issue. “Now we’ll be looking into it,” Bentz said.”

“MasterCard and American Express officials said they have been slowly rolling out new technology to make it easier for merchants and gift card users to know a card’s balance so it can be used with cash or another credit card to buy something for more than the card’s value.”

Very very few merchants allow you to check the balance of your gift card. Visa’s site lists about 15, while MasterCard’s site lists none, but says “some” can. Split transactions have not gotten any easier in the last two an a half years either.

If these companies are working on fixes to these problems, global warming appears to be melting glaciers faster.

Filed under: Fees & Breakage, Legal & Regulatory, Scams

Speaking of terminology, an article in today’s Wall Street Journal talks about “prepaid debit” cards. As debt among college students has risen to record levels in the last several years, colleges have gotten criticized for allowing credit card companies to aggressively promote credit cards to students on campus. In response, many colleges have limited credit card companies ability to hawk credit cards to students.

The result, according to the article is that banks are now pushing what they call prepaid debit cards. These are essentially the same as the open-loop (Visa, MasterCard, etc.) gift cards, but they are of the re-loadable variety. Essentially the same product but with a different name.

Oh, by the way, these cards are really loaded with fees.

The term “gift card” is a pretty generic one. There are quite a few other names used for sub-categories and classifications of different types of gift cards by industry insiders.

Open-Loop: An open-loop gift card is one that can be used in more than one store. Open-loop gift cards belong to one of the major networks; Visa, MasterCard, American Express, and Discover.

Closed-Loop: This is any card that can be used in one store or chain of stores only. For instance, Target, Home Depot, or Starbucks

Stored-Value: The strict definition of a stored-value card is a plastic card encoded with monetary value on a magnetic stripe. In addition to open-loop and closed-loop gift cards, prepaid phone cards, payroll cards, and transit cards also fall into this category. For most pracitical purposed, these days, money isn’t stored directly on the card, but in a database somewhere. It is very hard to tell whether there is any subtle differentiation between the meaning of stored-value and prepaid these days.

Prepaid: Here is a definition I found from the Federal Reserve (here): The term prepaid was associated with products for which the prefunded value is recorded on a remote database, which must be accessed for payment authorization. So defined, the term prepaid describes most of the products on the market today. There are a variety of applications for prepaid cards, including gift cards, payroll cards, flexible spending account cards, government benefit cards (such as food stamps), insurance claim cards, employee reward cards, travel cards, remittance payment cards, and transportation cards. Most prepaid cards serve a single purpose, but there are a few cases in which multiple prepaid functions are combined on one card. In addition, some cards, such as payroll cards, government benefit cards, and transportation cards, can be reloaded with value, while other cards, such as travel cards, insurance claim cards, and most gift cards, cannot.

Debit card: All of the open-loop cards issuers classify their cards as debit cards (they say DEBIT on them). When you do a transaction, it performs a debit from an account that has money in it. The difference between gift debit cards and bank debit cards that also hav a Visa or Mastercard logo is that gift debit cards (as far as I know) do not required you to enter a PIN when you use them. Actually, this is part of the problem with open-loop gift cards; despite their popularity with consumers, many merchants seem to be clueless as to how to run them. I’ve often been asked to provide a PIN when using a Visa gift card when none exists.

When you type in a domain name, like www.giftcardadvodate.org, the internet’s domain name system does a translation from that name to the actual address (like 192.168.1.23) that identifies the machine the website can be found on. The ZONE files are the files that the top level of the domain name system uses to start the name to address translation; these files contain every domain name registered at any given time.

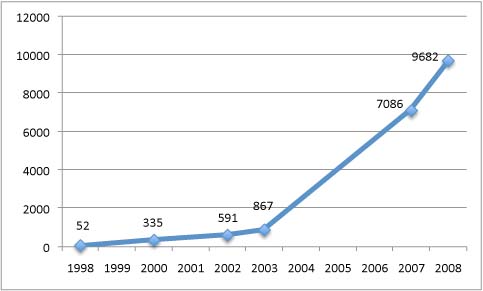

I’ve had access to these files since 1998 and have versions from various years between then and now sitting around. I thought it would be interesting as another view into the growth of gift cards to see how many domain names contain both the words “gift” and “card” at different times in the last decade ( top graph):

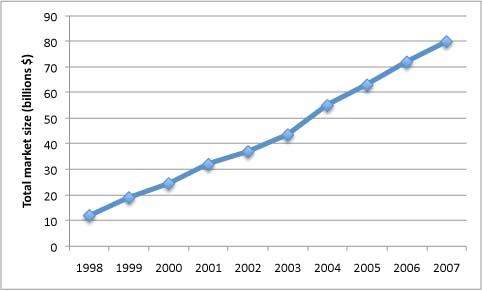

These are only .com domains. The graph includes some basic interpolation for the years I don’t have data for. If you are intested in the actual domain names registered in each year, here is the raw data: 1998, 2000, 2002, 2003, 2007, 2008. The graph on the right is the size of the gift card market according to an article in the Journal of Economic Perspectives.

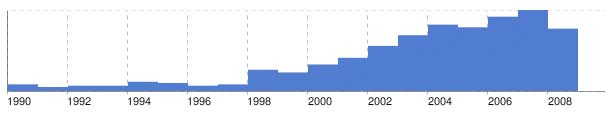

Google News Archive (historical news archives) has a great feature that shows a timline with the frequency a search term shows up in articles. Searching on “gift card” gives the following timeline.

This is a pretty good representation of the rise of gift cards. This timeline has gift cards on the scene way before I thought they were popular, which I previously thought was 2002.

Before about 1998, a gift card was a card that came with a gift apparently if you look at some of the hits. 2008 is smaller because it is not yet done (duh).

Also interesting, I found a reference to prepaid Visa gift cards from 2000. I think that after 9/11, pressure was put on the debit card gift card issuers to make them scarce because they were hard to trace (i.e. National Security issue). They disappeared for a few years mostly and then started making a comeback in the last few years. They were certainly a lot harder to find a few years ago than they are now. In 2005 I could only find them at the mall; now they are in just about every grocery store.

I’ve seen stories about debit card holds at gas stations since the Spring. The problem is that at a gas station, where the pump authorizes payment before it knows how much gas you will pump, it typically does an authorization for $50 or $75 first and then when you are done, releases the hold and runs the correct amount. These holds can stay on for quite a long time. With debit cards, this can tie up your funds, which is a problem if you don’t have a lot of funds.

With gift cards, the side-effect of holds can make your cards very hard to use. My experience has been that holds on gift cards can last up to 30 days for authorizations that are correctly canceled. When merchants process credit cards online, it isn’t possible to tell if any information is incorrect (CVV or expiration date) without doing an authorization, which puts a hold on the funds for up to 30 days, even if it is cancelled. Just how long is up to the cards issuing bank. Basically, you can lock up your gift card funds easily if you try to use it online and type in some of the info wrong.

Well, in the latest issue of Consumer Reports, there is an article about Consumers Union and other groups putting pressure on Visa and Mastercard to fix the debit hold problem, at gas stations in particular. Looks like Visa is moving to a real-time clearing process for gas stations.

I am curious to see the effect this will have on gift cards. One side-effect of the debit hold process at gas stations, as I found out by accident once, is that you can go to a gas station with a $50 gift card, it will do a pre-authorization for $50, and then you can charge more than $50 of gas on the card. This works at some, but not all gas stations. I wonder how often this happens. Like most cases of fraud, the merchant, not Visa, probably eats the loss in this case.

I found this post today regarding a service now being offered to collect used gift cards so that they can be recycled and turned into new gift cards. Seems to me the missing step is actually being able to completely use up your gift card before the service fees eat it alive or you just simply give up on it.

Searching Google News today for stories on gift cards, what I noticed is that almost all the stories I found that contained the term “gift card” are about companies that are giving out gift cards as rewards and such. Clearly, gift cards are becoming a way of life.

According to this Wall Street Journal blog entry, one Sharper Image gift card holder filed a class action suite on behalf of the Sharper Image gift card holders that are owed $19 million to make sure they are considered as creditors in the bankruptcy procedings.

Thanks for visiting giftcardadvocate.org. From my own difficulties using gift cards, I have done and continue to do a lot of research into how they work, the legal options for gift card related problems, options for gift card holders, and the industry in general. This site came out of my desire to share the information I found out and to help create more solutions for gift card users.

RSS