From our friends at the Federal Reserve comes this consumer friendly version of the new gift card rules.

I must say, I totally misunderstood the purpose of this business where you can rent a gift card holder and thought it was meant for giving individual gift cards. Turns out, the point is to rent a gift card holder for weddings to hold all the gift cards that people give you. I find this in many ways kind of sad, that people would choose to simply give a gift card over something more personal. But then again, most wedding gifts come from a list that the bride and groom choose for themselves so how much thought from the gift giver goes into the gift anyways?

Perhaps if this is where gift giving in general is headed. Why not? Amazon.com and many online stores have a wish list? Why not simply maintain a list of everything you want so people can easily find something you want. Of course, this removes any chance of receiving something truly surprising out of the mix, which again, is kind of sad.

I previously reported on the first Australian market gift card buy/sell/trade site cardnap.com.au. What I missed with the first look at this company is that it was created by a 15 year old.

Came across an interesting restriction while reading the terms & conditions for the US Bank Visa gift card: “Resale of Gift Cards is strictly prohibited.”

Wow, that’s quite a restriction. But the US Bank gift card is unattractive for their many fees, most of which will presumably change after the gift card rules from the Federal Reserve as per the Credit Card Reform Act of 2009 take effect in August. Their fees include $.50 for using the automated 800 number, $1.00 for talking to a live representative, a $2.50/mo inactivity fee after 12 months, $15 balance transfer or replacement fee, and a 3% foreign transaction fee. The worst though is that the terms & conditions include a hefty disclaimer that provides plenty of hoops you must jump through to get your money back if your card is stolen or otherwise used fraudulently.

I’m going to do a comparison to these current terms & conditions after August.

Since the Facebook free gift card scams broke out a couple of weeks ago, I’ve seen these same type of offers on other sites. A good rule of thumb is that no-one is giving anything away for free. That’s not how companies make money. But if your reading this blog, you probably are smart enough to know that. :)

www.giftcardconverter.co.uk is the first UK focused gift card site I’ve seen. An interesting tidbit in the article about this site is the claim that up to 25% of gift cards in the UK are unspent. The site will buy cards, trade them, or customers can donate them to charity. Cards donated to charity do not incur commissions, something we have yet to see from similar US based sites that provide the ability to donate to charities.

The numbers are in and wow, a lot of people fell for the free gift card scams on Facebook. Two separate Ikea scams netted about 110,000 people.

In order to sign up to supposedly get free gift cards, people had to give all their personal information (including dates of birth) and sign up for two marketing offers such as Netflix and CreditReport.com.

Seriously, did people actually believe that they would get a $500 or $1,000 gift card just for that?

A bill was introduced into the PEI legislature recently is similar to the new US Federal gift card laws under the credit card reform act of 2009, namely it limits expiration dates and severely limits fees.

This has got to be the most laughable report I have seen. The Gerson Lehman Group recently released a study that claims that prepaid cards are more cost effective than a checking account. They compare a checking account, at $300-$400 in annual fees to a prepaid card with $150-$250 per year in fees. I am guessing they chose a specific financial scenario that made the cards look more beneficial.

The other big things they left out:

A checking account builds a credit history, prepaid cards not so much

A checking account, you know, allows you to write checks

There are many many checking accounts that have NO fees

Checking accounts are safer and include FDIC backing

Inability to reject unauthorized charges on prepaid debit cards

But don’t just listen to me, read Consumers Union’s assessment of prepaid card.

Sometimes the fine print doesn’t even tell you the full story. Like this customer who received a $50 promotional gift card from Hollister for purchases she made there. The purchases were made on Dec 16 and when they tried to use the card the following February, they were told the card expired on Jan 31st. That sure doesn’t seem very generous of a promotion to give someone a gift card good for only a month. In addition to that, neither the gift card or the packaging had any expiration date on it, and in fact the gift card said “no expiration date” right on it.

But Hollister customer service wouldn’t budge from its position that the card would not be honored because it had expired. But then the customer contacted the local newspapers consumer advocate who contacted Abercrombie & Fitch, Hollister’s parent company. They immediately changed their position and even went as far as to give the customer double what they were entitled to, a $100 gift card.

What can we learn from this story?

a) Companies regularly make a habit out of nickel and diming people through the small print, even when it doesn’t say what they intended it to say.

b) Resolving an issue with a company through the media almost ALWAYS works! Contacting your local TV, radio, or newspaper’s consumer advocate, if they have one, is a very good tool for getting a company to budge on its unreasonable position.

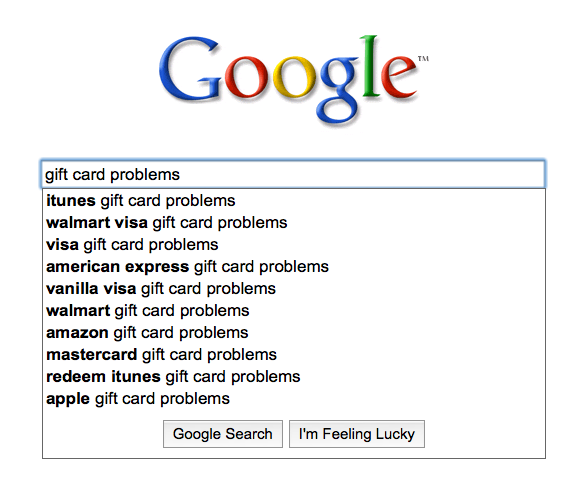

I’m not sure why I haven’t thought of this before, but since Amazon.com sells lots of different gift cards, and they have a pretty healthy and well-respected product review system, it is a perfect way to find out which kinds of gift cards people like the best, and what kinds of problems they might have.

I haven’t verified the legitimacy of this site, but GiftCardGiver.com will take any and all gift cards with any amount left on them. This is a much better way to get rid of your card with just a few bucks left on it. You simply write how much is on them with a Sharpie and mail them in. Sites like DonorsChoose.com will only take gift cards with full value on them.

A couple of items in this article are troubling: the claim that gift card laws are seldom enforced and the admission by the State of Louisianna (and probably by most States with gift card law) that complaints about gift cards are rare.

Why is this?

Just like with the proliferation of nickel and dime fees on everything from airlines to bank accounts, companies know that people rarely make a huge stink about a small amount of money list even though they despise it. And customers are easy to forget their frustration which keeps them feeding at the same tainted trough. Gift cards are no different. Companies that sell gift cards know damn well that most customers won’t bother to complain if they have a problem with their gift card. This is part of what helps them make money in a profit-by-small-fee fashion, which has become the norm for most businesses in this country.

A real shame.

Here is a TV news story about the gift card scam where someone scans the card before activation and then when it is activated they clone it and spend it. This story doesn’t really tell us anything new, but when you hear it from TV, it makes it sound like the scam is happening all the time. Perhaps it is. The anchor’s only suggestion is to buy a gift card from a customer service representative instead of a cashier? What exactly does that mean anyway?

My suggestion is to purchase your cards from an area inaccessible by customers, such as behind the register. If the only gift cards that are available are accessible to anyone, consider buying them online. I am no really surprised that stores like Target and Wal-Mart (the two mentioned in the story) haven’t fixed this problem by making their cards accessible only to cashiers. The reason they don’t do this is that cards that are hidden away don’t sell well and the voices of customers scammed in this way hasn’t turned into a roar yet.

According to this obvious PR-based article, prepaid debit and gift cards are already a huge hit for online purchases ($12 billion for prepaid and $2 billion for gift cards in 2009) and are set to explode to $38 billion for prepaids and $6 billion for gift cards by 2014, representing almost 10% of online sales.

What is obviously missing from this is the difficulty people often have in using these types of cards for online purchases. Having briefly run a service that cashes out open-loop gift cards, I can personally attest to the fact that these type of cards are all over the board as to how they behave (or misbehave) online, even as far as major differences between two cards issued from the same bank. From differing and sometimes totally random address verification handling to holds placed on funds after a failed authorization (because of AVS randomness) sometimes for weeks, these cards are hell to try and use online. In a store, all you have to do is swipe the card, no verification required. Online, you sometimes have to know precisely what address (if any) the card is registered to, which could be none, the gift givers address, or your own if you registered it, and other times the card doesn’t care about addresses. Some cards done care about address verification until you register them. Some cards just randomly stop working for no reason and you can’t get a hold of a real person to figure out WTF.

The bottom line is that easily over 50% of online transaction based on gift cards seem to fail, versus about 5% for traditional credit cards.

If you try to use your open-loop (Amex, Visa, Mastercard) gift card for certain purchases, you will find out just how futile it can be. The problem is that certain retailers will routinely try to authorize a certain amount just to pre-validate the card. For instance, if you want to use your card at the pump to buy gas, the pump will authorize $50 or $75 just to allow you to use the card, so if you have a card that is only worth $25, there is no way it will get accepted. People don’t notice this with credit or debit cards because they typically have a much higher credit limit or balance so it is never a problem. Restaurants also typically do this when running your card to leave extra room for a tip, even if you tell them to put a certain amount on the card.

Facebook ads and games are becoming legendary for their scammyness, and it should come as no surprise to anyone that ads for free gift cards on Facebook, such as for a $500 Olive Garden gift card or a $500 Whole Foods gift card where you have to enter your mobile phone number are completely bogus and will only result in unexpected charges on your phone bill.

Basic rule of thumb – if it sounds too good to be true, IT IS!

Update 4/5/10: Yikes, it looks like there is more than mobile phone numbers at stake here. Some of these gift card scams involve the installation of malware on the computers of people visiting the Facebook fan pages involved or other sites. Be careful!

I’m a little torn about this one. Friendgiftr has been infiltrating social networks with apps that allow people to purchase gift cards without ever having to leave sites like Facebook. You can also purchase them directly from their site. They recently announced a mobile device optimized store (but not native apps, why not?).

On the one hand, they do have a large selection of cards, but their selection isn’t much different than GiftCardMall, which, in addition to all the kiosks in grocery and other stores with lots of gift cards, sells them on their site.

Perhaps some people will get excited about a retailer like Friendgiftr, and it is convenient to have such a large selection of gift cards available all in one place. But I really can’t as I have never actually purchased a gift card as a gift. My interest in gift card comes from the fact that people seem to want to give them to me and I am such a cheapskate that I am determined to get every last dollar from every last one.

It was bound to happen; someone finally figured out how to scam open-loop (Visa type) gift cards at the checkout counter.

With closed loop card, the identifying numbers or bar are visible and can easily be read by theives. Once you activate the card that has been previously scanned by theives, they can tell through online tools when the card is active active and create a cloned card which they can use to spend. When you or the recipient go to use the card, it no longer has value.

With open-loop cards, this isn’t possible as the identifying information is hidden in the packaging and can not be easily copied.

The latest scam involves the thieves replacing the activation barcode on the outside of the packaging, which contains the code the identifies the card for activation, with a sticker that will activate a different card, which is in the posession of the thieves. The card you purchase never gets activated.

The way to protect yourself against this is to be sure and inspect the packaging for any anomalies that don’t look right, like a barcode sticker.

RSS